NO&T Capital Market Legal Update

This article is also available in Japanese.

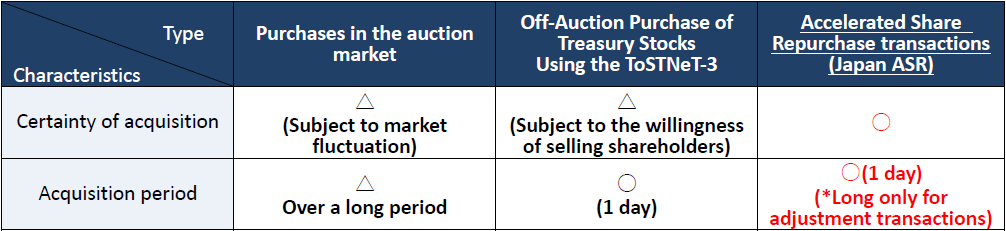

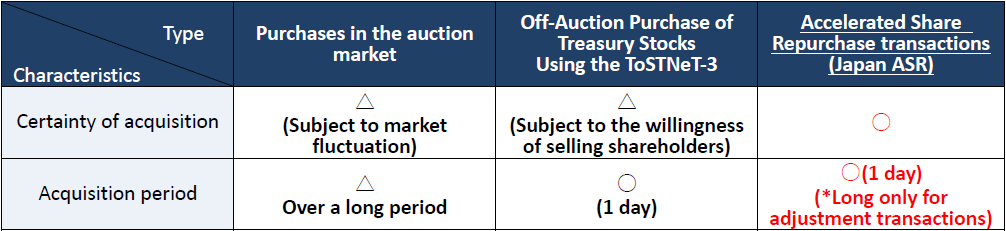

Smooth and reliable implementation of share repurchases is an important capital policy issue of listed companies in order to return profits to shareholders. Currently, for listed companies in Japan, market purchases of treasury stock are typically made through either (i) auction-market purchases※1 or (ii) off-auction purchases of treasury stock using the Tokyo Stock Exchange’s “ToSTNeT-3” system. Purchases in the auction market, however, are subject to market fluctuations and other factors, and it can be difficult to make through ToSTNeT-3 unless there are shareholders who already intend to sell shares. Therefore, even when a company announces a Board of Directors’ resolution regarding the repurchase of its own shares, in many cases it is difficult for the listed company to accurately convince its shareholders or prospective investors that the share repurchase will be certainly conducted with the actual volume and amount set forth in the announcement.

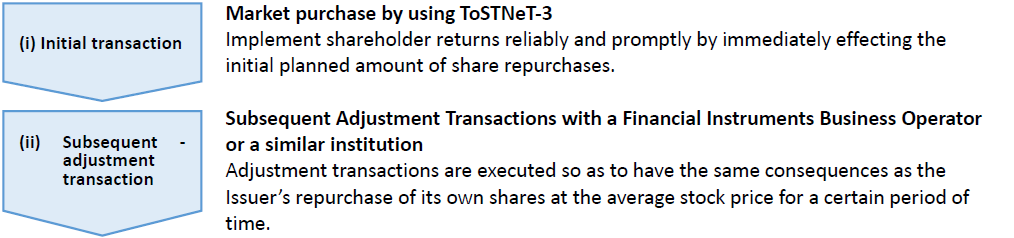

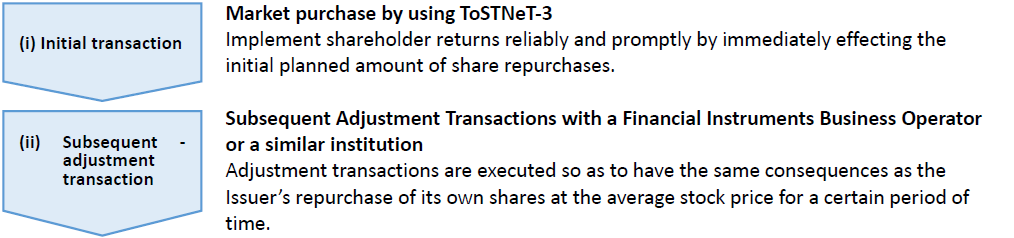

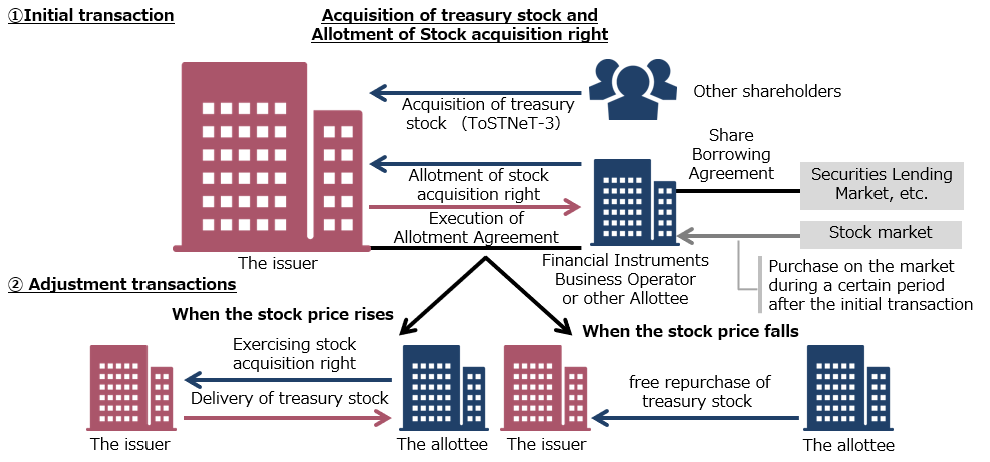

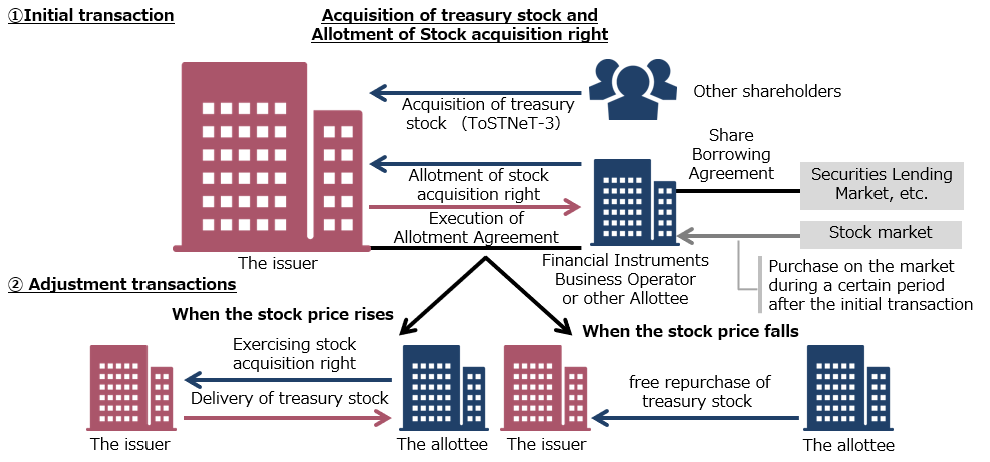

A “bulk share repurchase transaction” is the Japanese equivalent of the accelerated share repurchase transactions commonly used in the U.S. (such bulk share repurchase transactions hereinafter “ASR transactions”). In such an ASR transaction, a listed company (hereinafter referred to as the “Issuer”) executes a two-step method, consisting of (i) the initial transaction and (ii) the subsequent adjustment transaction.

This two-step procedure is intended to enable the Issuer to quickly recognize the effects of share repurchases in the capital markets.

We advised on the first ever ASR transaction in Japan, the Fully Committed Share Repurchase (or “FCSR”) of Joyful Honda Co., Ltd., proposed by Nomura Securities Co., Ltd. (the “Transaction”). Thus, as attorneys who have assisted with the development of the ASR transaction in Japan, we will outline its characteristics below.

The following is an outline of a standard ASR transaction (which is announced as an “FCSR” transaction in the Transaction).

(i) Initial transaction:

|

Acquisition of treasury stock |

Execution of off-auction repurchase of treasury shares using the ToSTNeT-3 system after announcement of Board of Directors’※2 resolution.

Characteristics: In the ToSTNeT-3 system, selling orders from general shareholders are accepted and executed in preference to the selling order for sale from a Financial Instruments Business Operator’s own account. |

|---|---|

|

Allotment of stock acquisition right |

Issuance of a stock acquisition right via third party allotment to the Financial Instruments Business Operator or other allottee.

Characteristics: Adjustment transactions are executed with respect to the number of shares entered into with the Financial Instruments Business Operator through ToSTNeT-3 as described above. |

(ii) Adjustment transactions:

If the Stock Price rises: When the average stock price is higher than the purchase price of treasury stock on ToSTNeT-3

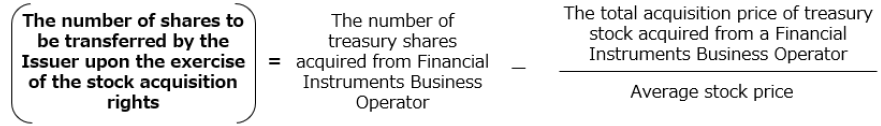

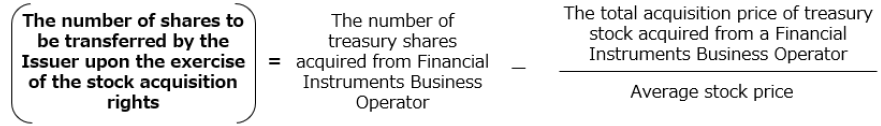

The Financial Instruments Business Operator or other allottee exercises its one stock acquisition right (by paying one yen) to receive the shares as calculated below.

If the Stock Price falls: When the average stock price is lower than the purchase price of treasury stock on ToSTNeT-3

The Issuer shall acquire treasury shares from Financial Instruments Business Operators or similar institution without charge.

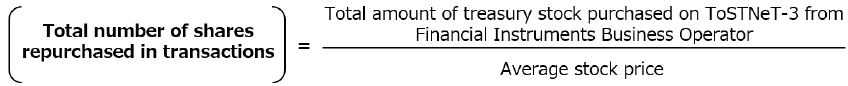

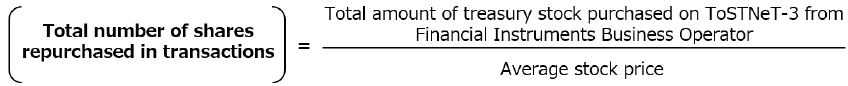

Regardless of whether the stock price rises or falls, the calculation method of the number of shares to be received by the allottee or the issuer remains basically the same.

(iii) Purpose of the transaction:

The purpose of the transaction is to adjust the total number of shares repurchased from the Financial Instruments Business Operator by using the amount paid by the Issuer on ToSTNeT-3 of the initial transaction so that this total amount will thus be the same as the result of repurchasing the number of shares when the Issuer repurchases its own shares at the average stock price.

As described above, it is assumed that the Financial Instruments Business Operator will borrow the number of the Issuer’s shares for which it has placed an order to sell on ToSTNeT-3, and in order to return the borrowed shares, the Financial Instruments Business Operator will purchase the Issuer’s shares in the market after the initial sale on ToSTNeT-3. Then, when the share price rises, the borrowed shares will be returned in a combination of the shares purchased on the market and the shares delivered by the exercise of the stock acquisition rights. Conversely, when the stock price declines, shares in excess of the borrowed shares will be delivered to the Issuer free of charge.

(iv) Benefits of the transaction

Two share repurchase transactions exist in FCSR transactions. No shareholder resolution is required in either case.※3

| (i) Share repurchase through ToSTNeT-3 in the initial transaction |

|---|

|

| (ii) Free acquisition of treasury stock at the time of a decline in stock prices |

|

Why isn’t a special resolution of shareholders meeting required when market transactions are used for stock repurchases (Article 165 of the Companies Act)?

| (i) All shareholders have an opportunity to sell |

|---|

|

| (ii) Repurchase is conducted at fair market value |

|

The Companies Act stipulates strict procedures for the acquisition of treasury stock from specific shareholders, such as a special resolution of the general meeting of shareholders:

| (i) Equalize opportunities to sell stocks that are difficult to cash in |

|---|

|

| (ii) Preventing the acquisition of high prices from greenmailing ⇒ Why this case is different |

|

Article 27, Item 1 of the Enforcement Regulations of the Companies Act does not impose any restrictions on procedure or distributable amount with respect to the free acquisition of treasury stock:

⇒ As long as any consideration is not paid by the Issuer, the acquisition of treasury stock does not have a harmful effect on the Issuer.

In cases where treasury stock is acquired without consideration, the stock acquisition right granted to allottee does not satisfy its exercise conditions and expires.

The issuance of stock acquisition rights does not impose any expenses on the Issuer, and the potential dilution of the value of shares held by existing shareholders should be considered under the Companies Act. When acquiring shares without consideration, stock acquisition right will expire without being exercised, so there will be no financial expenses to be borne by the Issuer or dilution to share value.

When considered in light of the entire transaction, the Issuer’s acquisition of its own shares is considered essentially “free”.

No additional cash is paid by the Issuer in subsequent adjustments of FCSR transactions.

The “Total book value of money, etc. to be delivered to shareholders,” under Article 461, Paragraph 1 of the Companies Act, can be calculated as of the date when the repurchase of treasury stock is conducted through ToSTNeT-3.

The total repurchase price of the relevant treasury stock is fixed in the initial transaction at the repurchase of treasury stock through ToSTNeT-3.

The amount available for distribution will not decrease in subsequent adjustment transactions (there will be an increase of only 1 yen if any stock acquisition right is exercised).

In FCSR transactions, the Issuer’s right to acquire shares without consideration is extinguished when the stock acquisition right is exercised (when the stock price rises), and the stock acquisition right is extinguished when the Issuer acquires its own shares without consideration (when the stock price falls).

This reciprocal structure ensures that the stock acquisition right and the right to acquire shares without consideration are considered as indivisible.

The allottee’s position in the FCSR transaction is just to make a settlement based on stock price increases or decreases up to a certain point in the future. Because the stock price can fluctuate either upward or downward as mentioned above, the allottee’s position is neutral and does not have any positive value. If both the stock acquisition right and the Issuer’s right to acquire shares without consideration are valued together, the value is zero.

The stock acquisition right is issued based on the valuation by a third-party valuator.

Therefore, it does not fall under the category of “specially favorable conditions” (Article 238, Paragraph 3, Item 1 and Article 240, Paragraph 1 of the Companies Act), which requires a special resolution of a general meeting of shareholders.

| Example 1: Convertible bond-type bonds with stock acquisition rights (“CB”) |

|---|

| A CB is a financial instrument which is essentially a combination of a bond with a stock acquisition right. The bond is inseparable from the stock acquisition right (Article 254, Paragraphs 2 and 3 of the Companies Act). When the stock acquisition right is exercised, the bonds are contributed in kind (Article 236, Paragraph 1, Item 3 and Article 284 of the Companies Act) and when the bonds are redeemed in advance, the stock acquisition rights cannot be exercised. |

| Example 2: Loan with stock acquisition rights |

| As with a CB, these are similar financing structures in which stock acquisition rights are inseparable from loan obligations. |

| Example 3: Stock Options |

Stock options are normally issued without any cash payment in recognition of services provided by officers and employees.

|

In an FCSR transaction, an allotment agreement of the stock acquisition right is executed. In principle, under the Companies Act, the board of directors of the Issuer has the discretion to determine the party to whom stock acquisition rights are allotted and with whom the agreement to acquire shares free of charge is entered into, provided that such allotment is not made under specially favorable conditions. Existing shareholders do not have preemptive rights with respect to such allotment, but FCSR transactions are designed to have zero value for the allottee, as noted above.

In order to comply with insider trading regulations, the Issuer must disclose all material facts prior to the ToSTNeT-3 repurchase of its own shares.

Announcement of details of each step of the transaction must be made:

In ASR transactions, the effects of share repurchases in the capital market, and therefore also the shareholder returns, can be quickly realized. In the U.S., Apple Inc. and other major companies commonly implement accelerated share repurchases. For many Japanese companies seeking to enhance shareholder returns and improve capital efficiency, smooth and reliable implementation of share repurchases is an important capital policy issue, and ASR transactions remain an effective option for such purposes.

*1

In order to avoid the risk of insider trading regulation violations, when using the auction market, it is common to use a trust involving appointment of a trust bank, or a discretionary account by appointing a financial instruments business operator or similar institution.

*2

Subject to the provisions of the Articles of Incorporation regarding authorization to the Board of Directors pursuant to Article 165, Paragraph 2 of the Companies Act or the provisions of the articles of incorporation that delegate the authority to decide on dividends of surplus, etc. pursuant to Article 459, Paragraph 1 of the Companies Act, a special resolution of a general meeting of shareholders shall not be required.

*3

See footnote No. 2.

This newsletter is given as general information for reference purposes only and therefore does not constitute our firm’s legal advice. Any opinion stated in this newsletter is a personal view of the author(s) and not our firm’s official view. For any specific matter or legal issue, please do not rely on this newsletter but make sure to consult a legal adviser. We would be delighted to answer your questions, if any.

Ryuji Oka

Yothin Intaraprasong, Theerada Temiyasathit (Co-author)

Yuichi Miyashita, Miho Susuki (Co-author)

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Yothin Intaraprasong, Theerada Temiyasathit (Co-author)

Yuichi Miyashita, Miho Susuki (Co-author)

Takashi Itokawa, Takahiro Kitagawa (Co-author)

Motoki Saito, Gaku Oshima, Yuta Kawamura (Co-author)

Yuan Yao Lee

Yusei Uji

Shunsuke Minowa, Poonyisa Sornchangwat (Co-author)

Shohei Sasaki, Shunsuke Minowa, Poonyisa Sornchangwat, Kwanchanok Jantakram (Co-author)

Yuan Yao Lee

Yusei Uji

Shunsuke Minowa, Poonyisa Sornchangwat (Co-author)

Shohei Sasaki, Shunsuke Minowa, Poonyisa Sornchangwat, Kwanchanok Jantakram (Co-author)