NO&T Capital Market Legal Update

This article is also available in Japanese.

In April 2022, Tokyo Stock Exchange, Inc. (“TSE”) restructured its cash equity markets into three new market segments: Prime Market, Standard Market, and Growth Market, with the aim of supporting sustainable growth and mid- to long-term improvement of the corporate value of listed companies, and of providing an attractive market that enlists strong support from a diverse base of investors in Japan and overseas.

In July 2022, for the purpose of reviewing the progress of market restructuring and investors’ evaluations in order to improve the effectiveness of the new market structure, as well as discussing measures to improve the corporate value of listed companies, TSE established an expert council called the “Council of Experts Concerning the Follow-up of Market Restructuring” (the “Follow-up Council”).

Following discussion by the Follow-up Council, on January 30, 2023, TSE published (i) an outline of proposed amendments to the listing rules (the “Draft Amendment”) by which TSE determines the timing to terminate the transitional measures regarding the continued listing criteria as March 2025, and (ii) TSE’s future initiatives to motivate listed companies to take action to improve their corporate value in the mid- to long-term (the “Response Policy”).

The Draft Amendment is currently open for public comment until March 1, 2023, and is scheduled to come into effect on April 1, 2023.

In this newsletter, we provide an outline of the Draft Amendment and of the Response Policy.

Under the current listing rules for new market segments that came into effect in April 2022, each listed company is required to meet the continued listing criteria for each market segment in order to maintain its status as a listed company in the relevant market segment (see Chart 1 below), while such continued listing criteria were heightened compared to the former delisting criteria applicable under the previous TSE market structure.※1 In connection with the introduction of such heightened continued listing criteria, TSE established transitional measures to achieve a smooth transfer to the new market segments. Under such transitional measures, applicable “for the time being” after the market restructuring in April 2022, a listed company that does not meet the regular continued listing criteria for each new market segment and whose shares were listed on the TSE market at the time of transition in April 2022 is eligible for the “relaxed” continued listing criteria (see Chart 2 below) if it discloses a plan to meet the regular continued listing criteria.

(Chart 1) Regular Continued Listing Criteria (Liquidity Criteria)※2

| Number of Tradable Shares (Units) | Market Cap of Tradable Shares | Tradable Share Ratio | |

|---|---|---|---|

| Standard Market | 2,000 or more | 1 billion yen or more | 25% or more |

| Prime Market | 20,000 or more | 10 billion yen or more | 35% or more |

| Growth market | 1,000 or more | 0.5 billion yen or more | 25% or more |

(Chart 2) Relaxed Continued Listing Criteria (Liquidity Criteria)

| Number of Tradable Shares (Units) | Market Cap of Tradable Shares | Tradable Share Ratio | |

|---|---|---|---|

| Standard Market | 500 or more | 0.25 billion yen or more | 5% or more |

| Prime Market | 10,000 or more | 1 billion yen or more | 5% or more |

| Growth market | 500 or more | 0.25 billion yen or more | 5% or more |

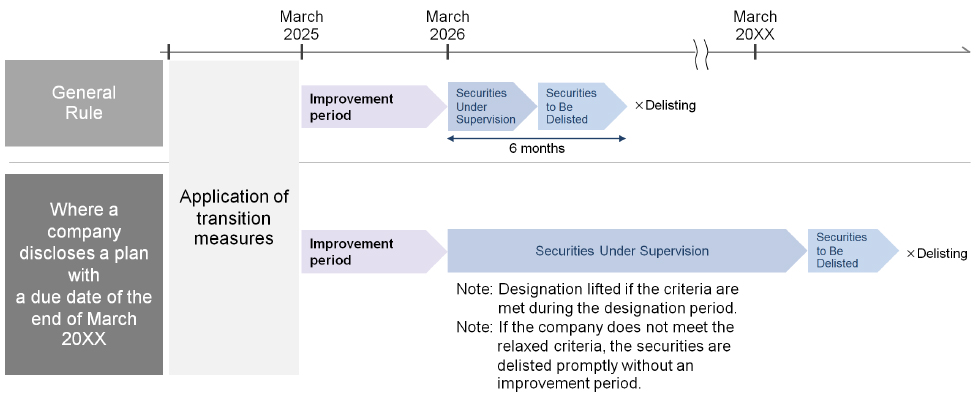

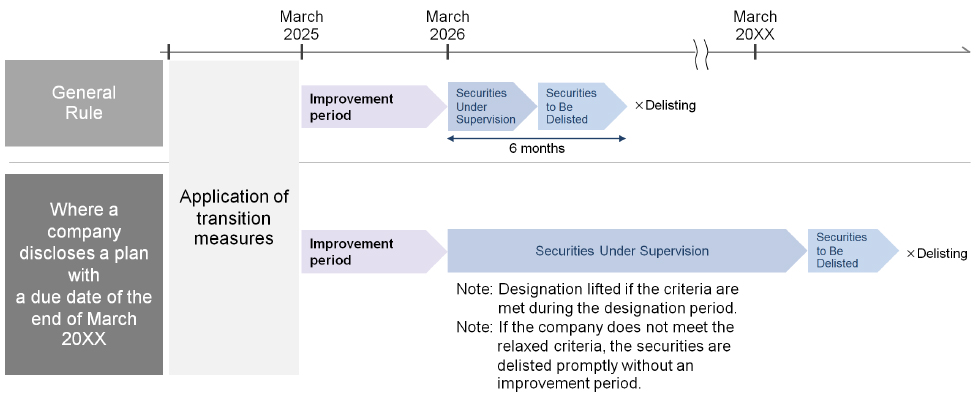

On this occasion, TSE clarifies the timing for end to such transitional measures. In the Draft Amendment, TSE proposes that the regular continued listing criteria be applied from a record date that arrives on or after March 1, 2025. A listed company that does not meet the continued listing criteria at such record date will be granted a one-year improvement period (six months in the case of the trading volume standards). If the listed company fails to meet the regular continued listing criteria within such one-year improvement period, the shares of that company will be designated as “Securities Under Supervision” and “Securities to Be Delisted”, and ultimately will be delisted from TSE (generally, a total six months after the end of the improvement period). Neither the Draft Amendment nor other TSE announcements make mention of TSE establishing another market or trading venue for such delisted shares (i.e., it appears that TSE will not establish any such market or venue).

The following chart illustrates the expected schedule for the termination of transitional measures for a company with a fiscal year ending March 31.

(Expected Schedule for Termination of Transitional Measures)

(Source: Tokyo Stock Exchange, Inc.)

As mentioned above, under the current transitional measures, by disclosing a plan to meet the continued listing criteria, a listed company that does not currently meet the regular continued listing criteria for each new market segment is eligible for the relaxed continued listing criteria.

Under the Draft Amendment, TSE proposes exceptional treatment for listed companies that have already formulated and disclosed a plan to meet the continued listing criteria with an end date that is after the first record date that falls on or after March 1, 2026. For a listed company that discloses such a plan before the date of implementation of the Draft Amendment (i.e., disclosure no later than March 31, 2023), the time of delisting of shares of such company will be extended to the end date of such plan (see the bottom part of the above image). The shares of such company are to be designated as Securities Under Supervision until the company is confirmed to have met or not met the criteria at the end of its plan.

According to TSE’s announcement, as it would be deemed inappropriate if a listed company were to extend the plan period with the aim of utilizing this proposed exceptional treatment, it is TSE’s position that TSE will carefully examine the rationale and other circumstances behind any changes in a plan that are made after the publication of the Draft Amendment.

In light of TSE’s decision on the termination of transitional measures as presented in the Draft Amendment, TSE will allow companies currently listed on the Prime Market that were listed on the First Section as of April 3, 2022, being immediately prior to the implementation of the market restructuring, to make an “application for reselection” in order to select the Standard Market. Such application for reselection will be permitted during the six-month period following the implementation date of this revision, i.e., from April 1, 2023 to September 29, 2023. Although, as a general rule, an application for change of market is subject to TSE’s examination equivalent to the new-listing examination implemented in connection with IPOs, including the obligation to file the “Sponsor’s Letter of Recommendation” prepared by the listing sponsor, there will be no such examination or filing obligation for the application for reselection to select the Standard Market as their listing segment.

As set forth in Charts 1 and 2 above, there are significant differences in the regular continued listing criteria for the Prime Market and the Standard Market, particularly the liquidity criteria. A company that has transitioned to the Prime Market may choose to move to the Standard Market by utilizing this application for reselection if they consider it difficult to satisfy the liquidity standards required for the Prime Market by the end of the transitional period.

TSE will compile every month a list of companies that have applied for reselection and publish a list on the JPX website on the fifth business day of the next month. TSE will also publish, on the JPX website on October 13, 2023, the names of listed companies that applied for segment reselection between the implementation date of this revision and September 29, 2023, and will implement the market segment transfers on October 20, 2023.

In order to ensure the effectiveness of the market restructuring, which was implemented with the aim of contributing to the improvement of the corporate value of listed companies, measures to encourage the improvement of corporate value in the mid- to long-term are announced in the Response Policy, covering listed companies that do not have problems in meeting the continued listing criteria.

Specifically, the Response Policy mentions four themes – (1) raise awareness and literacy about the cost-of-capital and stock price, particularly among companies with a PBR (Price Book-value Ratio) below 1x; (2) improve the quality of corporate governance, including emphasizing the importance of the “Explain” that appears in the Japan’s Corporate Governance Code (the “CG Code”); (3) further expand English-language disclosures; and (4) improve the effectiveness of dialogue with investors.

With regard to these measures, TSE considers it appropriate to make a framework respecting the autonomy of management of listed companies, rather than to implement micro-management for individual companies. Fundamentally, therefore, it seems that these measures will not necessarily result in amendment of the Security Listing Regulations, etc. so as to introduce punitive measures in the immediate future. However, listed companies should be aware of the issues indicated by the Follow-up Council and TSE, and should conduct management and disclosure with appropriate consideration of (1) to (4) above.

As for listed Japanese companies, for example, the number of companies with a PBR ratio※3 of less than 1x is about half of listed companies as a whole.※4 The Response Policy refers to measures to encourage management at listed companies to raise their awareness and literacy about the cost of capital, stock price, and market capitalization of listed companies and to promote efforts to improve these.

The details are as follows:

(a) Require listed companies in the Prime Market/Standard Market to properly identify the relevant company’s cost of capital and capital efficiency in management and on the board of directors, evaluate those statuses and the stock price and market capitalization, and disclose the policies and specific initiatives for improvement and the status of progress as necessary. (In particular in relation to companies whose PBR is constantly below 1x.)

(b) For all listed companies, review and revise TSE’s Code of Corporate Conduct set forth in the Security Listing Regulations in order to clarify the responsibility of listed companies such as in relation to awareness of the cost of capital profitability and respect for shareholders’ rights, especially the protection of minority shareholders’ rights, as well as, ensuring effectiveness of the Code of Corporate Conduct.

(c) For all listed companies, in addition to the above, in order to help raise awareness among management, promote understanding of and recommend stock compensation plans, inspect and update training content, such as e-learning on capital markets and corporate governance, and compile and publish case studies.

Among these, with respect to (a) above, notification to listed companies is scheduled to be given as a principle-based guidance based on the intent of Principle 5-2 of the CG Code.※5

Regarding the timing for implementation of (a) through (c) above, it is stated that (a) will be implemented in spring 2023, (b) will be implemented during FY 2023, and (c) will be implemented at an appropriate time from spring 2023.

Since the establishment of the CG Code, listed companies have made progress in their efforts to improve corporate governance, but polarization has become more apparent, and there are still a significant number of companies that have little awareness of the need to gain insight in order to improve their own management. Corporate governance has so far tended toward formalism, but there should be more focus on improving quality from now on. In particular, the Follow-up Council pointed out that “Comply or Explain” has become a formality for some companies. For example, there are some companies whose Explanations have been “under consideration” for several years. Under the Response Policy, TSE will re-emphasize the purpose of the “Comply or Explain” principle, clearly illustrate good or insufficient examples of Explanations, and encourage companies that do not properly implement “Comply or Explain” to correct the situation as necessary.

The details are as follows:

(a) For listed companies in the Prime Market/Standard Market, re-emphasize the purpose of the “Comply or Explain” principle, and clearly illustrate good or insufficient examples of the explanations.

(b) For listed companies in the Prime Market/Standard Market, investigate the actual status in respect of the roles, functions, and activities of the nomination committee and remuneration committee, and compile and publish the status and examples thereof.

Regarding the timing for implementation of (a) and (b) above, (a) is set for spring 2023 and (b) is set for autumn 2023.

Given that the ratio of overseas investors is particular low for companies with small market capitalization, and disclosure in English in respect of the companies in the Prime Market is insufficient despite the fact that the Prime Market is designed for companies committed to dialogue with global investors, the Response Policy includes measures to (a) encourage companies listed in the Prime Market to expand the coverage of English disclosure practices and eliminate the time lag between the publication of documents in Japanese and English, with a view to making English disclosure of necessary information mandatory when the transitional measures for the continued listing criteria are terminated and (b) promote voluntary English disclosure practices in the Standard Market and Growth Market.

The details are as follows:

(a) Decide and announce the matters to be made mandatory in English disclosure of companies listed on the Prime Market, while continuing to implement individual approaches, information dissemination activities and other initiatives.

(b) Compile and publish case studies of English disclosure in each market segment for all listed companies, and promote English disclosure practices in the Standard Market and Growth Market by introducing case studies.

The timing for implementation of (a) and (b) above is set for autumn 2023 in both items.

The Response Policy includes initiatives to encourage constructive dialogue with investors, as companies are still reluctant to engage in dialogue with stakeholders, including investors. In addition, the Response Policy includes initiatives for independent directors to promote an appropriate understanding of their expected roles, as they are expected to supervise the management upon entrustment by shareholders, such as proactively responding in dialogue if requested by investors.

The details are as follows:

(a) For listed companies in the Prime Market, require that they include in their corporate governance reports the status of dialogue between management and investors and the content of such dialogue.

(b) For all listed companies, conduct educational activities to promote understanding of the expected roles for independent directors (such as sending booklets to independent directors that refer to their expected roles).

(c) Consider measures to increase awareness and interest in dialogue with companies among asset owners, such as corporate pension funds, in cooperation with stakeholders.

Regarding the timing for implementation of (a) through (c) above, (a) and (b) are to be implemented in spring 2023 and (c) will be implemented at an appropriate time from spring 2023.

With regard to the termination of transitional measures related to the listing criteria proposed in the Draft Amendment, it is expected to be an urgent matter for Japanese listed companies that are subject to the transitional measures to reform their management and business structure in order to increase corporate value, or to accelerate and conclude discussion and negotiation with shareholders to meet the regular listing criteria such as the liquidity criteria. Some listed companies may wish to apply for reselection to the Standard Market as necessary. Each investor who invests in such a company should pay close attention to the corporate action and announcements of the company in the near future.

In addition, listed companies that are not subject to the transitional measures should further reform their mindset in order to increase corporate value, based on the Response Policy and the discussion of the Follow-up Council. In particular, listed companies whose PBR is less than 1x are required to ascertain their cost-of-capital and profitability, and to consider and disclose policies and specific measures to improve these. Furthermore, each company listed on the Prime Market and the Standard Market is required to re-examine the content of “Explanation” under the CG Code and, if required, take steps to bolster such Explanation. In addition, each company should develop an internal system to implement and promote its English disclosure with keeping in mind that certain English disclosure obligations may be imposed on Prime Market-listed companies in the future.

*1

For the details of TSE’s market restructuring, see TSE’s webpage at https://www.jpx.co.jp/english/equities/market-restructure/market-segments/index.html.

*2

For details of the regular continued listing criteria, see TSE’s webpage at https://www.jpx.co.jp/english/equities/market-restructure/market-segments/b5b4pj0000049j6c-att/Criteria_en.pdf.

*3

Calculated by “Share price/Net assets per share.”

*4

According to the “Reference material (data of listed companies)” dated July 29, 2022, 50% of companies listed on the Prime Market (922 companies) have a PBR ratio of less than 1x, and 64% of companies listed on the Standard Market (934 companies) have a PBR ratio of less than 1x as of July 1, 2022.

*5

Japan’s CG Code Principle 5-2 provides that “[w]hen establishing and disclosing business strategies and business plans, companies should articulate their earnings plans and capital policies, and present targets for profitability and capital efficiency after accurately identifying the company’s cost of capital. Also, companies should provide explanations that are clear and logical to shareholders with respect to the allocation of management resources, such as reviewing their business portfolio and investments in fixed assets, R&D, and human capital, and specific measures that will be taken in order to achieve their plans and targets.”

This newsletter is given as general information for reference purposes only and therefore does not constitute our firm’s legal advice. Any opinion stated in this newsletter is a personal view of the author(s) and not our firm’s official view. For any specific matter or legal issue, please do not rely on this newsletter but make sure to consult a legal adviser. We would be delighted to answer your questions, if any.

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Takehito Matsumoto

(June 2025)

Ichiro Oya, Masayuki Fukuda, Hideaki Suda, Tsutomu Endo (Co-author)

Takashi Itokawa, Takahiro Kitagawa (Co-author)

Motoki Saito, Gaku Oshima, Yuta Kawamura (Co-author)

(December 2024)

Hiromi Hattori, Yuichi Miyashita (Co-author)

Motoki Saito

Chattong Sunthorn-opas, Thunsinee Sungmongkol (Co-author)

Ario Putra Pamungkas

Long Nguyen

Rashmi Grover

Chattong Sunthorn-opas, Thunsinee Sungmongkol (Co-author)

Ario Putra Pamungkas

Rashmi Grover

(December 2024)

Hiromi Hattori, Yuichi Miyashita (Co-author)