NO&T Real Estate Legal Update

NO&T Infrastructure, Energy & Environment Legal Update

With the rapid increase in data processing accompanying the development of AI and digitalization, there is a growing demand for data centers to store and process data. Recently, there has been a surge in data center development projects in Japan, and it is expected that a variety of new developments, including hyperscale※1 data centers and small-scale urban edge data centers, will be actively pursued in the future. On the other hand, there are certain characteristics of data centers that prevent their full categorization as either traditional real estate projects or project-based ventures; the unique status of data centers gives rise to legal considerations which must be taken into account in development and operation.

This newsletter provides an overview of the key legal considerations related to the structuring of data center development and operation. In the next issue, we plan to address issues related to permits, approvals, and power procurement.

As of March 2024, the number of data centers in Japan stands at 219, which is significantly fewer than the number of data centers in the United States (approximately 5,400) and major European countries※2 (approximately 2,100)※3. However, in recent years, there have been numerous announcements of investment plans for domestic data center development by Japanese companies. Furthermore, large-scale investment plans by foreign IT companies for data centers in Japan are estimated to reach trillions of yen, even where only the most recent announcements are taken into consideration.

The government has also expressed support for domestic data center development, positioning data centers as one of the strategic sectors in the “Grand Design and Execution Plan for a New Form of Capitalism—2024 Revision” (approved by the Cabinet on June 21, 2024). Additionally, the Ministry of Internal Affairs and Communications and the Ministry of Economy, Trade and Industry have been holding expert meetings on the development of digital infrastructure (including data centers) since October 2021. In the “Interim Summary 3.0” published on October 4, 2024, they outlined four specific recommendations for developing digital infrastructure to support an AI society by the 2030s: (i) further promoting the decentralized location of data centers, (ii) promoting the research, development, and social implementation of cutting-edge technologies, (iii) decentralizing landing stations for submarine cables and establishing and enhancing international presence, and (iv) coordinating with GX policies.

Furthermore, it has been noted that the data center market environment is evolving towards larger-scale facilities. By the end of 2023, hyperscale data centers had surpassed retail data centers, and it is predicted that the number of hyperscale data centers will continue to increase rapidly in the future※4. With the advancement of cloud computing, the demand for regional on-premise data centers has been decreasing as organizations shift from on-premise setups to the cloud. Consequently, there is a further concentration of data centers in the Tokyo and Osaka metropolitan areas※5.

When examining the various legal issues related to the development and operation of data centers, it is important to understand that data centers have characteristics that differ from other types of real estate assets (such as offices and residences).

First, the relative value of the land and buildings (for data centers, the improvements are largely structural) in a data center is comparatively low. When selecting a location for a data center, various factors need to be considered, including (i) the distance from major demand locations (populated areas and Internet Exchange (IX) points)※6, (ii) the availability of infrastructure such as power, fiber optics, and water, (iii) convenience and coexistence with local residents, (iv) the availability of space for constructing large buildings, and (v) natural disaster risks. Generally, hyperscale data centers, in particular, are often built in suburban areas. As a result, the cost of acquiring land tends to account for a relatively small portion of the total project cost. Additionally, although buildings need to meet certain load-bearing, seismic, and waterproofing requirements, the structural design is typically simple compared to other asset types, resulting in lower construction costs for the building shell in relation to the total project cost. In contrast, the value of the equipment constituting the functional core of a data center, such as power reception facilities, substations, Uninterruptible Power Supplies (UPS), emergency generators, cooling equipment, servers, and network equipment, can be significant. The legal consequences may vary depending on whether this high-value equipment is treated as part of the real estate or as movable property in various scenarios.

Second, like hotels, the profitability of a data center as real estate can vary depending on the operator’s management capabilities, which gives data centers the nature of an operational asset. Therefore, more attention needs to be paid to the smoothness of operations and the characteristics of the operator, as compared to non-operational assets such as offices and residences. This is particularly true when it comes to considering the data center from a structuring perspective, and with respect to the regulatory issues necessary for development and operation.

Third, data centers consume a large amount of electricity. The power reception capacity of data centers in the 2000s, when browsing websites and emails were the primary forms of internet usage, was typically on the order of several tens of megawatts (MW). However, there has been an increase in the construction of hyperscale data centers for cloud applications with capacities of several tens of MW since around 2020. It is expected that data centers with capacities ranging from hundreds of MW to gigawatts (GW) for AI learning and inference will increase in the future※7. Meanwhile, responding to the demands of megacloud operators who are keen on reducing their greenhouse gas emissions, the greening of power consumption has become a critical factor influencing the value of data centers. For developers of data centers, it is increasingly important not only to improve energy efficiency but also to secure renewable energy, utilizing mechanisms such as corporate Power Purchase Agreements (PPAs)※8.

Finally, as facilities that handle vast amounts of data and serve as the brains for generative AI, data centers are extremely important from an economic security perspective. In this regard, the government has also designated the domestic location of data centers as a national issue※9. Furthermore, pursuant to the Economic Security Promotion Act※10, the government began operating a system on May 17, 2024, to ensure the stable provision of essential infrastructure services. Suppliers of information processing systems designated as specific critical equipment (refer to Article 50, Paragraph 1 of the Act) to specific infrastructure operators※11 or contractors maintaining or operating such systems are required to cooperate with specific infrastructure operators by providing information necessary for filing notifications.

In practice, various methods are used for the structuring of data center development and operation. It is common for businesses, primarily real estate developers, to develop and operate data centers either independently or through joint venture SPCs (Special Purpose Companies) formed in partnership with other companies (typically foreign data center operators). On the other hand, traditional real estate securitization methods are also employed, utilizing GK-TK (Godo Kaisha – Tokumei Kumiai) or TMK (Tokutei Mokuteki Kaisha) structures. Additionally, forms such as specific joint real estate ventures and investment corporations owning data centers are also conceivable.

Below, we will provide some considerations on the issues related to the GK-TK structure and the TMK structure, which are frequently used in current practice.

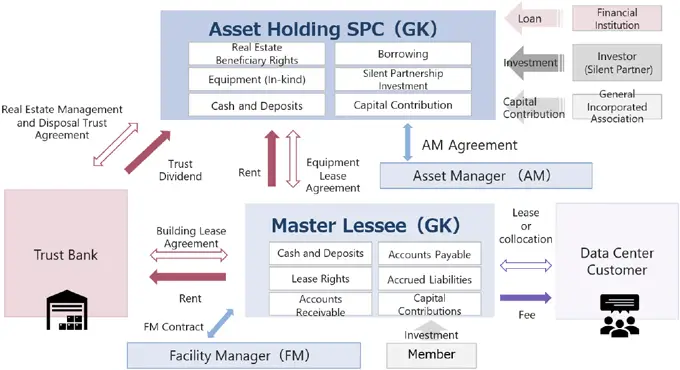

A typical GK-TK structure in real estate securitization practice generally involves the following: (i) A GK (Godo Kaisha; a form of LLC) with 100% ownership held by a general incorporated association or similar entity acquires, from the originator, real estate trust beneficiary rights, which rights have been transferred to a trust bank by the originator (only land in the case of development projects). (ii) The GK raises funds for the purchase of these trust beneficiary rights (or purchase and construction funds in the case of development projects) by receiving silent partnership (Tokumei Kumiai) contributions from investors and by borrowing non-recourse loans from financial institutions (see Figure 1).

Figure 1: Example of a GK-TK Structure in a Data Center Project

When using a GK-TK structure in the development and operation of data centers, one of the primary considerations is its relationship with the Act on Specified Joint Real Estate Ventures (hereinafter referred to as the “REVA”). Under the REVA, to professionally engage in activities such as entering into real estate specified joint enterprise contracts※12 and distributing revenues or profits arising from real estate transactions※13 conducted based on such contracts, it is generally necessary to go through the approval procedures stipulated by the REVA (see Article 3 of the REVA). For tangible real estate, there is a possibility that the REVA may apply, which would require the operator to be a licensed business under the law, thereby reducing flexibility in structuring the product. Therefore, it is common practice to convert real estate into trust beneficiary rights when using a GK-TK structure. In the case of data centers, considering the significant proportion of equipment such as power supply systems, cooling systems, and network equipment, as well as the different aspects of managing these facilities compared to traditional real estate management, it is essential to discuss on a case-by-case basis whether trust banks or similar entities will agree to undertake this as a trust product equivalent to traditional real estate management and disposal trusts.

Additionally, in general real estate securitization transactions, including data centers, the GK-TK structure often encounters issues related to the silent partnership nature (TK status), leading to stability concerns from both legal and tax perspectives. When developing and operating a data center with foreign investors (foreign operators or investors), if TK status is denied by the competent authorities, it could give rise to Permanent Establishment (PE) issues from a tax standpoint, resulting in domestic sourcing of income for distributions to foreign investors, thereby significantly impairing investment efficiency. Furthermore, although there is no established consensus on the legal consequences of TK status, practically, it is possible that it would be recognized as a partnership, thus imposing unlimited liability on the anonymous partners (TK members) for the debts of the GK. Due to the absence of clear criteria for confirming TK status, practitioners often face challenges in ensuring the preservation of this status. Given the operational asset nature of data centers, the actual development and operation often rely heavily on the know-how and skills of the substantive sponsor (the related entity of the anonymous partner). Therefore, it is vital to maintain a well-balanced approach to preserving the project’s TK status while leveraging the necessary expertise and skills in the actual development and operation.

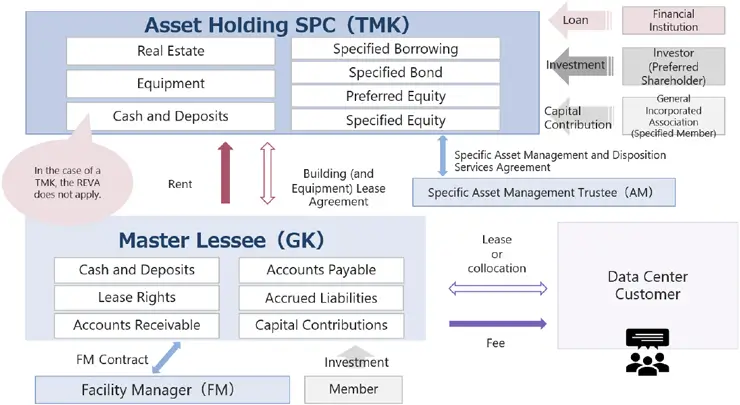

A TMK structure is a method that utilizes a Special Purpose Company (TMK), established under the Act on Securitization of Assets (the “ASA”), as a vehicle for holding specific assets and issuing securities. Unlike the GK in a GK-TK structure, a TMK is a vehicle specifically authorized under the Asset Securitization Act for the securitization and liquidation of assets (see Figure 2).

Figure 2: Example of a TMK Structure in a Data Center Project

When utilizing a TMK structure for the development and operation of data centers, one of the main advantages is that since a TMK can hold real estate in its tangible form, it is not necessary to convert the real estate interest into trust beneficiary rights. Additionally, if the conduit requirements under the Special Taxation Measures Law (see Article 67-14, Paragraph 1 of the same law) are met, it is possible to deduct profit distributions from taxable income, thereby avoiding double taxation, which provides greater tax stability compared to the GK-TK structure.

On the other hand, since a TMK serves as a vehicle for the securitization of assets and is subject to supervision by administrative authorities under the law, it has less flexibility in terms of institutional design compared to the GK-TK structure. For example, when a TMK engages in asset securitization activities, it must file a notification (commencement of business notification) in advance (see Article 4, Paragraph 1 of the ASA). At the time of this notification, a Basic Asset Securitization Plan outlining the fundamental aspects of the asset securitization by the TMK must be submitted, and any changes to the notified matters or the content of the Asset Securitization Plan, except for minor changes, must be reported to the relevant local finance bureau (see Article 9 of the ASA), which complicates operations. In the case of data centers, when a TMK holds movable property as specified assets, unless the same can be qualified as ancillary specified assets, it must be described in the Asset Securitization Plan (see Article 5, Paragraph 1, Item 3 of the ASA). Therefore, any changes or updates would require modifications to the Asset Securitization Plan and notifications to the relevant local finance bureau. Practically, it is important to categorize movable properties, which are expected to be frequently updated due to maintenance or disposal, as ancillary specified assets that do not need to be listed in the Asset Securitization Plan. However, given the relatively high value of ancillary equipment in data center assets, there are often circumstances where it is difficult to treat such equipment as ancillary specified assets; therefore, routine replacements and other changes to this ancillary equipment may require notification to the local finance bureau if the TMK structure is selected.

Moreover, a TMK must conduct asset securitization activities and its ancillary operations in accordance with the Asset Securitization Plan and cannot engage in other activities (see Article 195, Paragraph 1 of the ASA – prohibition of other business activities regulation). “Asset securitization” refers to a series of activities whereby the TMK acquires assets using funds obtained through the issuance of asset-backed securities or specified borrowings, or a trust bank or similar financial institution receives the assets in trust and issues beneficiary certificates. The money obtained from the management and disposal of these assets is used for the fulfillment of obligations related to the asset-backed securities, specified borrowings, and beneficiary certificates, for the acquisition or redemption of these obligations, or for the distribution of surplus assets (see Article 2, Paragraph 2 of the ASA). Especially when operating high-value hyperscale data centers, there are situations where it is necessary to provide services to customers that might qualify as members of construction, security, or waste disposal industries, in addition to merely offering space equipped with power and cooling systems. However, if a TMK violates the prohibition on other business activities, it may not only be subject to supervisory action (see Article 218 of the ASA) but also fail to meet one of the conduit requirements under the Special Taxation Measures Law (Article 67-14, Paragraph 1, Item 2(b) of the same law), with significant adverse tax consequences. Therefore, it is necessary to design a data center operation scheme that does not violate the prohibition on other business activities, which may sometimes require sacrificing some flexibility in institutional design.

As mentioned above, data centers are infrastructure facilities requiring advanced technology and high operational reliability. In addition to the building structure, various ancillary equipment is necessary, including servers, racks, elevators, power supply and distribution equipment, emergency power generation equipment, power storage equipment, air conditioning systems, sanitary equipment, disaster prevention equipment, and security systems. Data center-related equipment varies widely, ranging from devices like servers, which can be relatively easily physically removed and replaced, to equipment such as water supply and drainage piping, which is more firmly affixed to the building structure.

When data center-related equipment is part of the building rather than movable property, it can be legally categorized as part of the building, and there is no need for separate handling. Regarding this point, Article 242 of the Civil Code stipulates that “[t]he owner of a real estate acquires the ownership of a thing that has acceded to the real estate as an accessory. However, this does not interfere with the rights of another person who has affixed the thing under a title.” The law does not clearly specify the criteria to determine to what extent the movable property must be integrated into the building to be considered an accessory (“thing that has acceded”) and thus part of the real estate, including whether the owner of the building (structure) acquires the ownership of such movable property. Additionally, case law has not provided a unified opinion on this matter.

For example, there are judicial precedents concluding that equipment such as water supply, drainage pumps and fire-fighting equipment installed in a building accede to the building. This conclusion was drawn based on factors such as the difficulty of physical separation (e.g., being embedded in walls or fixed with bolts), being installed as ancillary equipment of the building, and the decrease in social and economic value of both the building and the equipment upon separation※14. Additionally, there are precedents involving air conditioning systems, elevator-related equipment, and substation equipment, where the conclusion was that these systems are fixtures of the building because they are essential for the building, and their separation would significantly diminish the socio-economic value of both the building and the equipment※15. Conversely, there are judicial precedents in which the courts denied accession for items such as window sashes, fittings, and doors installed by subcontractors in a building, on the grounds that they can be removed, exist independently, and their removal does not cause physical damage or significant economic loss to the building※16. Furthermore, regarding elevators installed in a condominium, there are precedents that focused on the ease of physical separation, noting that the elevators could be removed without losing functionality and used in another building, and that the condominium itself would not need to be demolished for elevator removal. Additional factors included the removal cost being less than 10% of the installation cost, the small number of units requiring the elevator, and the presence of stairs, all leading to the conclusion that the separation did not result in significant social and economic disadvantages, thereby denying accession※17.

Based on the above considerations, determining whether data center-related equipment accedes to a building requires a comprehensive evaluation of factors like the purpose, function, shape, structure, and installation conditions of both the building and the equipment. Specifically, the assessment may need to take into account (i) the presence and degree of physical damage upon separation, (ii) the cost required for separation, and (iii) the economic value reduction or social and economic disadvantage to the building or equipment resulting from separation. Each piece of equipment needs to be judged on an individual basis.

In the data center business, it is common for a data center operator to lease a building from the building owner and then bring in and install various related equipment such as servers and racks. In such cases, the building owner and the tenant (data center operator) often come to an agreement as to the respective ownership and management responsibilities of their assets. However, whether such division can be freely determined solely based on the agreement of the parties raises the question of what constitutes “title” in the proviso of Article 242 of the Civil Code, which as noted above contains the qualification that “[t]his does not interfere with the rights of another person who has affixed the thing under a title.”

The Civil Code does not specifically define “title”, and there is no uniform opinion on this in case law. For example, a precedent holds that the portion of a building that was extensively renovated and expanded (restaurant space) by removing other structures except for two pillars and the ceiling beam, was deemed to be owned by the tenant based on “title”, considering that the renovated part was independent from the existing house and the tenant had obtained the landlord’s consent for the renovation※18. Conversely, another case ruled that an upper floor added to an existing building, which could only be accessed via a ladder from the original building, was considered part of the existing building’s structure, and despite the tenant having obtained the landlord’s consent for the extension, the upper floor was regarded as acceding to the existing building (the tenant could not retain ownership based on “title”)※19. Based on these precedents, a strong connection between the building and the ancillary items at issue (as in the case of the new upper floor which could only be accessed by ladder), known as strong accession, is not affected by the “title” proviso of the article, whereas acceptance of ownership retention based on “title” is more likely in cases of weak accession※20.

Although discussions on this matter have not yet reached resolution, as a practical matter, if any data center-related equipment is sufficiently independent from the building to warrant public notification, and there is a special agreement between the building landlord and tenant that the equipment remains the asset of the tenant (if such matters are explicitly stated in the lease agreement or in other documentation), it is likely reasonable to expect that the tenant can retain ownership based on “title” (the equipment does not constitute part of the building). Such an arrangement would not contradict the above caselaw precedents.

With respect to the elements discussed in Section 5(1), some data center-related equipment may not easily constitute part of the building (hereinafter referred to as “non-building components”). As mentioned in Section 4(3), if a TMK acquires and holds non-building components along with the building, such non-building components are generally subject to regulation as “specified assets”. Such assets need to be listed in the TMK’s asset liquidation plan (Asset Liquidation Law, Article 5, Paragraph 1, Item 3), and if there are changes to the non-building components, a change notification must be submitted (Article 9 of the same law). However, constantly submitting change notifications for updates to the non-building components can be cumbersome, making it a practical issue whether non-building components qualify as “affiliated specified assets”, which do not need to be listed in the asset liquidation plan (Article 4, Paragraph 3, Item 3 of the same law).

“Affiliated specified assets” are specified assets that meet the following five requirements:

In the case of a data center business, the value of data center-related equipment often exceeds the value of the principal specified assets, the building and land. Thus, the functional and economic relationship, particularly the economic hierarchy as mentioned in criterion (iii), becomes a critical issue. It is necessary to compare the relative economic values of the entire building, including components constituting part of the building as discussed in Section 5(1)(2), and the non-building components. It is not unreasonable to expect that the economic value of non-building components may be greater than that of the building itself. Hence, further discussion with and guidance from the competent authorities is needed with respect to the “economic hierarchy” test in determining affiliated specified assets, including methods for calculating value to judge relative economic value of building and non-building components※21.

Regarding non-building components such as mechanical, electric and plumbing components that do not meet the requirements for “affiliated specified assets” (hereinafter referred to as “movable MEP”), it is often the case in practice to establish and acquire/hold these components through a separate SPC (Special Purpose Company) (often utilizing a GK). Here are two points to consider in such instances:

Please be sure to read our second newsletter in this series, which covers legal issues pertaining to data center operation.

*1

Data centers can be broadly classified into two types: hyperscale data centers, which are built with the expectation of use by mega cloud service providers (hyperscalers), and retail data centers, which are designed to allow multiple customers to use them by the rack (colocation). This newsletter will mainly focus on discussing hyperscale data centers, which are expected to see a significant increase in demand in the future.

*2

The cumulative total of the seven countries: Germany, United Kingdom, France, Netherlands, Italy, Poland, and Spain

*3

Ministry of Internal Affairs and Communications “2024 Edition of the Information and Communications White Paper” p. 158

*4

Expert Meeting on the Development of Digital Infrastructure (such as Data Centers) “Interim Summary 3.0” (October 4, 2024) (hereinafter referred to as “Interim Summary 3.0”), p. 5

*5

“Interim Summary 3.0” p. 5

*6

Generally, the further the distance, the longer the latency (the delay in communication time that occurs from when the CPU or other device issues a data transfer request until the data is actually transferred).

*7

“Interim Summary 3.0” p. 3. Additionally, according to the forecast for electricity demand over the next ten years, published by the Organization for Cross-regional Coordination of Transmission Operators, Japan (OCCTO) on January 22, 2025 (OCCTO “National and Supply Area-specific Demand Assumptions (FY2025)”), electricity demand had been declining until FY2023 due to factors such as population decline and energy conservation. However, from FY2024 onwards, while the impact of energy conservation will continue, the national demand for electricity in FY2034 is expected to be approximately 852.4 billion kWh, representing an increase of about 6% compared to FY2024, due to factors such as the expansion of areas anticipating new or expanded data centers and semiconductor factories.

*8

The government aims to guide the recently increasing number of data centers to suitable locations such as those near carbon-free energy sources (7th Basic Energy Plan, p. 25) and to ensure the discipline of system connection applications for data centers, among others. Additionally, the government plans to promote location guidance through the “Welcome Zone Map”, which indicates areas where general electric utility companies can start power supply early (ibid., p. 46).

*9

Council for Realizing New Capitalism “Grand Design and Implementation Plan for New Capitalism, 2024 Revised Edition” (June 21, 2024), p. 42

*10

The official name is “Act on Promotion of Ensuring Security through Integrated Implementation of Economic Measures (Act No. 43 of 2022)”

*11

Among the providers of designated critical infrastructure services such as electricity business, gas business, petroleum gas import business, water supply business, water utility business, railway, maritime, aviation, and airport business, transportation business, telecommunications business, broadcasting business, postal business, and financial services, and those that are designated by the competent minister pursuant to the standards set by the relevant ministerial ordinance because the function of the specific critical equipment they use (equipment, machinery, devices, or programs used for designated critical infrastructure services that are important for the stable provision of such services and may be used as a means to obstruct the stable provision of such services from outside Japan as specified by the Cabinet Office Ordinance Concerning the Designation of Designated Critical Infrastructure Operators pursuant to the Act on Promotion of Ensuring Security through Integrated Implementation of Economic Measures) may cease or degrade, resulting in significant disruption to the stable provision of such designated critical infrastructure services and potentially jeopardizing national and public security.

*12

A typical contract involves collecting funds from investors through partnership agreements, silent partnership agreements, etc., to engage in real estate transactions and promising to distribute the profits from those transactions to the investors (refer to Article 2, Paragraph 3 of the REVA).

*13

The term refers to the sale, exchange, or lease of real estate (Article 2, Paragraph 2 of the REVA). Additionally, in the context of the REVA, “real estate” refers to land or buildings as stipulated in Article 2, Item 1 of the Real Estate Brokerage Act (Article 2, Paragraph 1 of the REVA).

*14

Tokyo District Court Judgment dated November 27, 1967, Hanji No. 516, p. 52

*15

Tokyo District Court Judgment dated January 28, 1980, Hanta No. 410, p. 107

*16

Osaka District Court Judgment dated April 23, 1973, Hanta No. 306, p. 223

*17

Kumamoto District Court Judgment dated August 7, 1979, Lower Court Civil Case Collection, Vol. 30, Nos. 5–8, p. 367. In the aforementioned judgment, the entire elevator system was in question, and accession to the building was denied. However, in the judicial precedent cited in footnote 4, accession to the building was affirmed for the equipment controlling the operation of the elevator and the motor operating the elevator’s hoisting machine, illustrating that whether the building’s equipment is considered to accede to the building varies depending on the case.

*18

Supreme Court Judgment dated October 29, 1963, Minshu Vol. 17, No. 9, p. 1236

*19

Supreme Court Judgment dated July 25, 1969, Minshu Vol. 23, No. 8, p. 1627

*20

Atsushi Omura, Hiroto Dogauchi, and Keizo Yamamoto (Editors-in-Chief), Taro Ogayu (Editor), “New Commentary on Civil Code (5) Property (2)” p. 499, etc. However, there are opposing views, such as Yoshihisa Nomi and Shintaro Kato (Editors), “Issues Systematized: Case Law on Civil Code 2 Property [4th Edition]” pp. 386-387.

*21

The statutory wording only states “used as an accessory”, and the mention of economic subordination comes from the regulatory authorities’ response to public comments made during the introduction of the “subordinate specified asset” framework into the Act on Securitization of Assets (for example, Response No. 4 in the results of the public comments regarding the amendments to the Financial Instruments and Exchange Act, etc. (effective within six months) in 2011). Therefore, it appears that there is room to broaden the discussion without amendments to the statutory text.

*22

The issue is whether it falls under “conducted as a business” as defined in Article 2, Paragraph 1 of the Money Lending Business Act.

*23

In practice, it is often considered whether it falls under the intercompany loans described in Item 6, Article 1-2 of the Enforcement Order of the Money Lending Business Act or loans from shareholders to joint ventures in the context of joint ventures. In this regard, when the SPC is a limited liability company (LLC), a more complex examination is required because the “voting rights” mentioned in Items (ii) and (iii) are not stipulated in the Companies Act.

This newsletter is given as general information for reference purposes only and therefore does not constitute our firm’s legal advice. Any opinion stated in this newsletter is a personal view of the author(s) and not our firm’s official view. For any specific matter or legal issue, please do not rely on this newsletter but make sure to consult a legal adviser. We would be delighted to answer your questions, if any.

Masato Kumeuchi, Kodai Ebihara (Co-author)

Hoai Tran

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Masato Kumeuchi, Kodai Ebihara (Co-author)

Hoai Tran

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Masato Kumeuchi, Kodai Ebihara (Co-author)

Hoai Tran

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Takehito Matsumoto

Yuan Yao Lee

Ryuji Oka

Yothin Intaraprasong, Theerada Temiyasathit (Co-author)

Yuichi Miyashita, Miho Susuki (Co-author)

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)