NO&T Capital Market Legal Update

On July 17, 2025, the Working Group on the Disclosure and Assurance of Sustainability-related Financial Information (“Working Group”) of the Financial System Council in the Financial Services Agency of Japan published a roadmap paper for introducing in Japan statutory disclosure standards equivalent to the IFRS Sustainability Disclosure Standards set by the International Sustainability Standards Board (“ISSB”)※1. The roadmap paper outlines the current status and direction of discussions on the incorporation of the sustainability disclosure standards set by the Sustainability Standards Board of Japan (“SSBJ”) into the statutory disclosure framework of the Financial Instruments and Exchange Act of Japan (“FIEA”). According to the roadmap paper, Prime Market-listed companies with certain significant market capitalization will be required to disclose sustainability information in accordance with the standards of the SSBJ. The roadmap paper is intended to provide an interim summary of the relevant issues, and a definitive conclusion will be considered in the future.

This newsletter offers an overview of the roadmap paper.

Under the current FIEA, listed companies and certain other companies must generally disclose annual securities reports within three months of the end of each fiscal year. These reporting companies must include the disclosure of sustainability information in their annual securities reports. The sustainability section comprises four elements: governance, strategies, risk management, and metrics and targets. The current disclosure rules under the FIEA do not set specific standards for sustainability issues, including climate change. Consequently, the quantity and quality of sustainability information disclosed varies depending on the discretion of each reporting company.

In March 2025, the SSBJ set three sustainability disclosure standards (collectively, the “SSBJ Standards”):

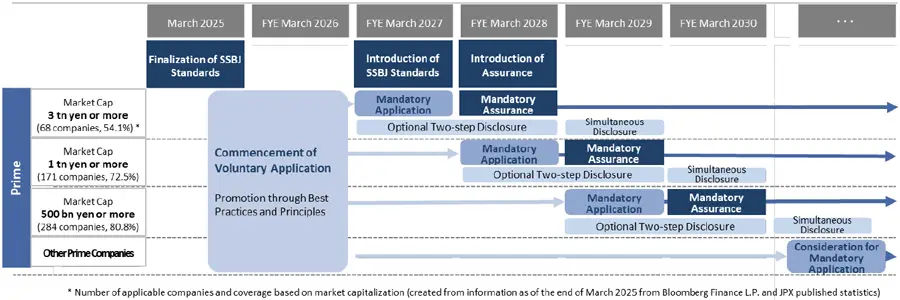

These standards are more detailed and aim to promote globally consistent and comparable disclosures for capital markets. They are based on the IFRS Sustainability Disclosure Standards, which establish a global baseline for sustainability disclosures. Since the SSBJ Standards are not laws or regulations per se, the Working Group has discussed how to incorporate the SSBJ Standards into the statutory disclosure items within annual securities reports. The roadmap is as follows:

Roadmap for Implementation of the SSBJ Standards

Source: English translation prepared by us based on “Roadmap for the Application of Sustainability Disclosure Standards and the Introduction of an Assurance Framework” published by the Working Group on July 17, 2025

In accordance with the roadmap, the timings for the implementation of the SSBJ Standards and third-party assurance for companies subject to these standards are as follows:

| Subject Companies | Timing for Implementation of SSBJ Standards | Timing for Implementation of Third-Party Assurance |

|---|---|---|

| Prime Market-listed companies with a market capitalization of 3 trillion yen or more | Fiscal year ending March 2027 | Fiscal year ending March 2028 |

| Prime Market-listed companies with a market capitalization of less than 3 trillion yen but 1 trillion yen or more | Fiscal year ending March 2028 | Fiscal year ending March 2029 |

| Prime Market-listed companies with a market capitalization of less than 1 trillion yen but 500 billion yen or more | The basic target is fiscal year ending March 2029, subject to further discussion based on domestic and international trends and other factors. Aim to reach a conclusion by the end of 2025. | The fiscal year following the implementation of the SSBJ Standards |

| Prime Market-listed companies with a market capitalization of less than 500 billion yen | Continue to review in light of companies’ disclosure status, investor needs and other factors. Aim to reach a conclusion within several years. | |

When considering the scope of subject companies, the Working Group referenced the Jurisdictional Guide published by the ISSB in 2024. The Jurisdictional Guide provides guidance for jurisdictions introducing local sustainability disclosure standards that ensure functional alignment with the IFRS Sustainability Disclosure Standards. Companies listed on the Prime Market with a market capitalization of 1 trillion yen or more account for over 70% (171 companies) of the total market capitalization of all companies listed on the Tokyo Stock Exchange. Considering the statistics, the Working Group expects that the IFRS Sustainability Disclosure Standards will be considered “fully transposed” into the regulatory framework of Japan when the SSBJ Standards are applied to these companies. The method for calculating market capitalization will be discussed further in the future.

Furthermore, due to the varying levels of preparedness among companies in responding to sustainability disclosures under the current legal framework, as well as the significant disparities in the available disclosure resources, the Working Group considered it reasonable to introduce the SSBJ Standards in phases based on the scale of market capitalization. In addition, third-party assurance will be introduced starting from sustainability information for the fiscal year ending March 2028. This is prior to the implementation of the disclosure of sustainability information by non-EU companies under the EU Corporate Sustainability Reporting Directive (“CSRD”) for the fiscal year ending March 2029 (for companies with a March fiscal year-end). The application of the SSBJ Standards is anticipated to begin in relation to sustainability information for the fiscal year ending March 2027, preceding the introduction of third-party assurance.

Additionally, the European Commission proposed an “Omnibus Bill” to relax the CSRD regulations in February 2025. Considering this trend, the Working Group takes a position that there are significant differences between the situations in the EU and Japan. In particular, the EU aims to introduce the CSRD across a wide range of companies, including non-listed companies, while Japan aims to introduce the SSBJ Standards and third-party assurance for a limited scope of companies. Therefore, the Working Group concluded that this trend in the EU does not affect Japan’s roadmap.

Some companies may initially have difficulty preparing annual securities reports that comply with the SSBJ Standards by the deadline, which is within three months of the end of each fiscal year. The SSBJ Standards stipulate that sustainability-related financial disclosures must be reported “simultaneously” with the financial statements included in the annual securities report. However, the SSBJ Standards allow for an exception to such simultaneous reporting if it is permitted by law. Considering this, the roadmap paper proposes introducing a two-step disclosure process as a transitional measure. Specifically, for the first two years (beginning on the year that the SSBJ Standards take effect and continuing through the first year of third-party assurance), companies can opt for the two-step disclosures instead of the simultaneous disclosures, which means that companies may disclose the annual securities report with the financial statements as the first step by the deadline of the annual securities report, and then disclose sustainability-related financial information as the second step by the deadline for semi-annual securities reports.

According to the FIEA, a reporting company may be liable for damages to investors and subject to penalties or other sanctions if its statutory disclosure documents, including annual securities reports, contain false statements, omissions or misleading information (“misstatements”) in material respects.

In this context, compared to financial information, sustainability information is considered to have relatively higher uncertainty due to the following characteristics:

If companies become overly concerned about liability risks due to such uncertainties and avoid the proactive disclosure of useful information in annual securities reports, it would undermine the expected improvement in sustainability information disclosures. Therefore, the roadmap paper proposes a safe harbor for liability for misstatements to enhance the level of disclosure in annual securities reports. The concept of such safe harbor is as follows and further discussions on the details are ongoing.

Safe Harbor Concept

| Item | Summary |

|---|---|

| Scope | Misstatements of Scope 3 GHG emissions |

| Requirements |

Must meet both of the following criteria:

|

| Effect | Even if it is later found that the quantitative information regarding Scope 3 GHG emissions is incorrect, the company will not be liable for the misstatements if the requirements are met. |

Designing a third-party assurance system for sustainability information is a significant issue that will affect the practical burden on reporting companies. The Working Group has formed an expert subgroup to discuss this matter. While the Working Group has not yet reached a consensus on all issues, the following is a summary of the discussions to date.

Status of discussions on assurance

| Item | Summary |

|---|---|

| Scope of Assurance |

|

| Level of assurance |

|

| Eligibility of assurance service providers |

|

*1

https://www.fsa.go.jp/singi/singi_kinyu/tosin/20250717.html (Japanese text only)

This newsletter is given as general information for reference purposes only and therefore does not constitute our firm’s legal advice. Any opinion stated in this newsletter is a personal view of the author(s) and not our firm’s official view. For any specific matter or legal issue, please do not rely on this newsletter but make sure to consult a legal adviser. We would be delighted to answer your questions, if any.

Ryuji Oka

Yothin Intaraprasong, Theerada Temiyasathit (Co-author)

Yuichi Miyashita, Miho Susuki (Co-author)

Makoto Saito, Shinichiro Horaguchi, Yoshihisa Watanabe, Ramsay Randall (Co-author)

Yothin Intaraprasong, Theerada Temiyasathit (Co-author)

Yuichi Miyashita, Miho Susuki (Co-author)

Takashi Itokawa, Takahiro Kitagawa (Co-author)

Motoki Saito, Gaku Oshima, Yuta Kawamura (Co-author)

Supasit Boonsanong, Thananya Pholchaniko, Phareeya Yongpanich (Co-author)

(August 2025)

Kaori Sugimoto

(July 2025)

Rintaro Hirano, Yutaro Fujimoto, Yurika Masakane, Yutaro Kato (Co-author)

Yuichi Miyashita, Miho Susuki (Co-author)

Supasit Boonsanong, Thananya Pholchaniko, Phareeya Yongpanich (Co-author)

Yuichi Miyashita, Miho Susuki (Co-author)

(December 2024)

Hiromi Hattori, Yuichi Miyashita (Co-author)

(September 2024)

Ryosaku Kondo (Comments)