Motoki Saito Motoki Saito

Partner

Tokyo

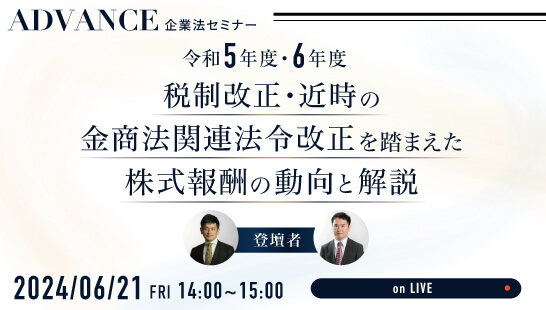

ADVANCE Corporate Law Seminar

1. Tax Qualified Stock Options Pre-2024 Tax Reform

2. Paid Stock Options (Stock Acquisition Rights Issued at Market Price)

3. Last Year’s Amendments to the Circular

4. Overview and Details of the 2024 Tax Reform

5. Key Legal Considerations on the 2024 Tax Reform

6. Amended Industrial Competitiveness Enhancement Act (Stock Option Pool Provisions)

7. Insider Trading Regulations – Considerations on the Granting of Restricted Transferable Shares

8. Disclosure Regulations (Stock Options, Restricted Shares, PSU/RSU)

9. Q&A

Research Center for Social Systems, Shinshu University・Embassy of Japan

Daisuke Fukamizu (Project Organizer), Ayumi Fukuhara (Moderator)

Embassy of Japan, Washington, D.C. / Online

2025 AIPPI World Congress

Kenji Tosaki (Moderator)

PACIFICO Yokohama North

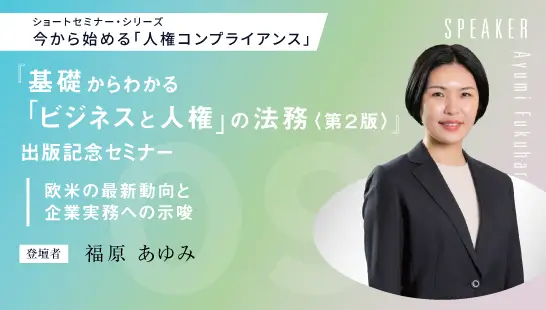

Compliance Seminar Series on Business and Human Rights

Ayumi Fukuhara

Online (On-Demand)