Hitoshi Sumisawa Hitoshi Sumisawa

Special Advisor

Tokyo

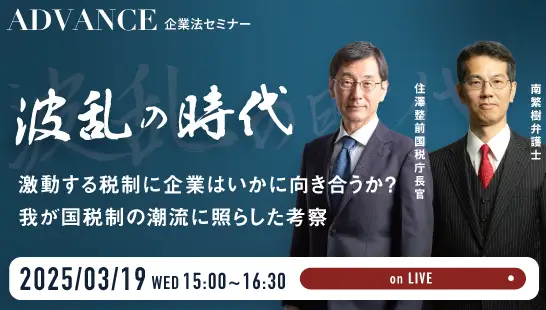

ADVANCE Corporate Law Seminar

In the period following the conclusion of the Cold War in the late 1980s, Japan’s tax system underwent substantial transformations. These developments encompass the introduction of a consumption tax, the broadening of the tax base, and the reduction of the corporate tax rate.Moreover, Japan has adopted numerous international tax systems and experienced a prevalence of tax litigations.

Mr. Hitoshi Sumisawa, former Commissioner of the National Tax Agency of Japan, who was responsible for planning and implementing the tax system reforms at the National Tax Agency, will discuss the history and background of the 40-year period of changes.In response, Mr. Shigeki Minami, a lawyer who has handled a number of tax lawsuits, will discuss the challenges and conflicts faced by companies in adapting to the constantly evolving system from a corporate perspective. Additionally, Mr. Minami will pose questions to former Commissioner Sumisawa.

2025 AIPPI World Congress

Kenji Tosaki (Moderator)

PACIFICO Yokohama North

Compliance Seminar Series on Business and Human Rights

Ayumi Fukuhara

Online (On-Demand)

CIArb (EAB) Japan Chapter YMG

Shota Toda

Nishimura & Asahi