Kosuke Hamaguchi’s practice mainly involves public and private M&A transactions and corporate governance. He also regularly advises clients on corporate crisis management. Based upon his experiences overseas, he represents international companies in numerous cross-border projects. In particular, he is recognized for his expertise in strategic M&A transactions and alliances.

Haseru Roku’s practice focuses on complex cross border activity, including M&A, international trade and economic security related matters. Based on his strong in-bound and out-bound experience as well as his work at top tier law firms in the U.S. and China, his expertise also lies in trade friction, cross-border transactional disputes, and negotiations for acquisitions and joint ventures with companies in the Greater China area (mainland China, Singapore, Hong Kong and Taiwan). He is fluent in Chinese and English in addition to his native Japanese.

Oki Osawa advises on corporate legal affairs, primarily focusing on M&A and other corporate restructuring and general corporate matters. He was seconded to the Ministry of Economy, Trade and Industry (among others, the Security Trade Control Policy Division; International Investment Control Office; and Minister’s Secretariat (Economic Security)) and engaged in work related to economic security, including policymaking and the operation and enforcement of the foreign direct investment regulations under the Foreign Exchange and Foreign Trade Act (FEFTA).

The regulations (“FDI Regulations”) for foreign direct investments (“FDI”) under the Foreign Exchange and Foreign Trade Act (“FEFTA”) governs, among other things, the investments of foreign investors※ in Japanese companies. FDI Regulations not only function as one of the essential policies for ensuring economic security but are also important regulations that significantly impact practices relating to M&A, shareholders’ meetings, and so on.

In addition, a series of related legislative revisions have recently been made, and this has raised practical interest in FDI Regulations more than ever.

In this discussion, Mr. Hamaguchi and Mr. Roku, who are frequently involved in cases related to FDI Regulations, and Mr. Osawa, who engaged in policymaking, operation, and enforcement of FDI Regulations in Ministry of Economy, Trade, and Industry (METI) until last month, discuss FDI Regulations and the practice thereof.

Hamaguchi

Osawa

Hamaguchi

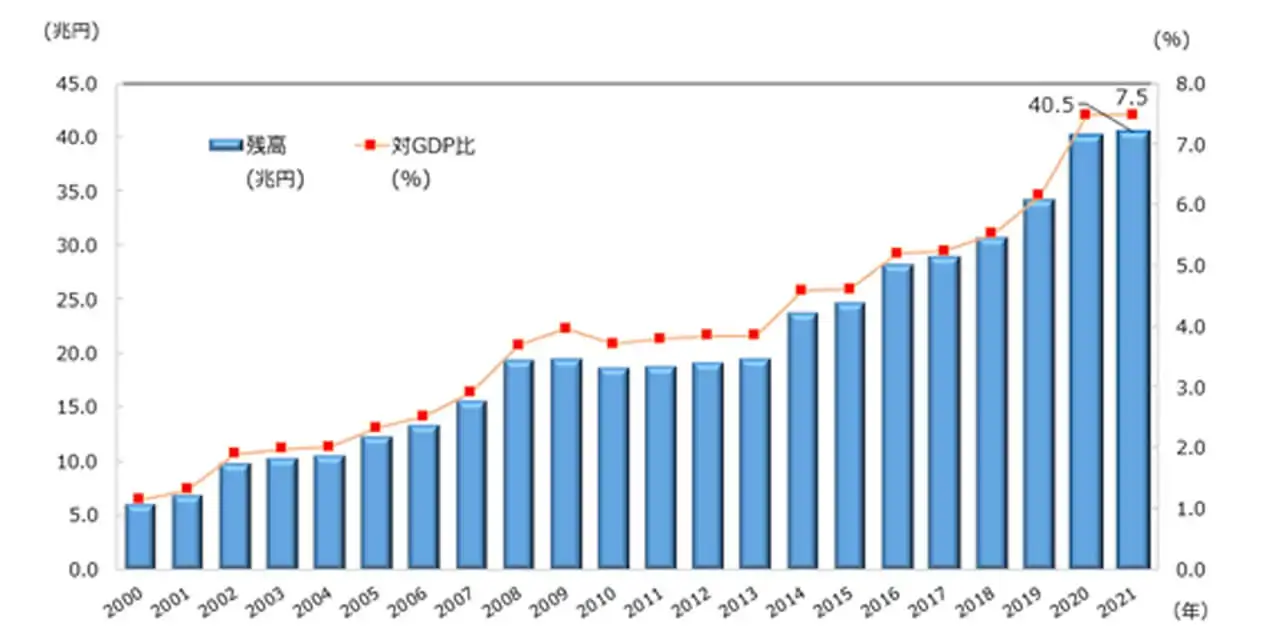

Trend of Recent FDI stock in Japan

(Source:https://www.jetro.go.jp/invest/investment_environment/ijre/report2022/ch1/sec2.html)

Osawa

Roku

Osawa

Hamaguchi

Osawa

Roku

Osawa

Hamaguchi

Osawa

Hamaguchi

Osawa

Hamaguchi

Osawa

Hamaguchi

Osawa

Major recent revisions to FDI Regulations

| 2017 |

① Introduction of the prior notification regime for specific acquisitions Acquisitions of unlisted shares by foreign investors from other foreign investors (specific acquisitions) related to particular business sectors have become subject to prior screening. ② Introduction of an order for measures The Government has been granted the authority to issue an order for measures (such as an order for sale of shares) against foreign investors if such investors had conducted FDIs without mandatory prior notification or with a false notification and if the FDIs pose a risk of impairing national security. |

|---|---|

| 2019 |

The cyber-related business sector was added to the Designated Business Sectors. FDIs in the cyber-related business sector have become regulated from the viewpoint of appropriately preventing situations that may seriously affect national security. |

| 2020 |

To further promote FDIs that contribute to the sound development of Japan’s economy, while appropriately dealing with investments that may jeopardize national security,special provisions for the exemption of the prior notification dutywere stipulated in particular cases.Besides, the scope of FDIs subject to the mandatory prior notification was amended.

|

|

Medical manufacturing industries, etc., were added to the Designated Business Sectors. Given the COVID-19 pandemic, the manufacturing industry related to medicine for infectious diseases and the manufacturing industry related to specially controlled medical devices were added to the Designated Business Sectors. The aim of this revision was to maintain the domestic manufacturing infrastructure of the important medical industries related to citizens’ lives and health and appropriately prevent situations that could seriously affect the security of Japan and its citizens’ life and health. |

|

| 2021 |

Expanding the scope of the Designated Business Sectors to secure a stable supply of critical minerals To secure a stable supply of critical minerals and overcome the vulnerability of supply chains, etc., certain business sectors related to 34 critical minerals (such as rare-earth elements) and the construction business sectors for maintaining the port facilities of specific remote islands, etc., were added to the Designated Business Sectors. |

Hamaguchi

Osawa

Roku

Osawa

Roku

※

“Foreign investors” prescribed in Article 26, Paragraph 1 of FEFTA.For instance, this refers to individuals who are non-residents, foreign companies, and Japanese companies in which voting rights of 50% or more are held by non-resident individuals or foreign companies.

(Kosuke Hamaguchi,Haseru Roku,Oki Osawa)

This roundtable discussion is intended to provide brief general information for your reference only and does not constitute legal advice from the firm. The opinions expressed are the personal views of the authors and do not represent the views of the firm. Due to the nature of the information being general information, the citation of the text and sources of laws and regulations may be intentionally omitted. Please always consult a lawyer on issues relating to individual specific cases.