Yosuke Kanegae Yosuke Kanegae

Partner

Tokyo

NO&T Restructuring Legal Update

This article is also available in Japanese.

This article is also available in Chinese.

Since the full liberalization of the electricity retail business in April 2016, new electricity retailers (so-called Power Producer and Supplier (PPS)) have steadily entered the market. As of November 26, 2021, the number of registered electricity retailers were 733※1 and, as of June 2021, the share of electricity sales by PPSs had grown to approximately 21.3% for the special high-voltage, high-voltage and low-voltage sectors※2.

Most PPSs do not own their own power plants. As such, significant development has occurred in relation to the environment in which those PPSs can procure the necessary electricity from trading markets, such as Japan Electric Power Exchange (“JEPX”), which has helped to promote new entrants. In recent years, the expansion of renewable power has resulted in lower JEPX prices, particularly during periods of low demand. This has been an important factor behind the expansion of JEPX transactions.

However, between December 2020 and January 2021, Japan experienced unprecedented electricity supply and demand pressures caused by an increase in demand due to an unexpected cold wave and a shortage of LNG stocks. In JEPX, prices soared and electricity was continuously sold out. In the JEPX spot market, the system price, which had previously averaged less than 10 yen/kWh, temporarily exceeded 250 yen/kWh. Furthermore, the imbalance fee, which is imposed on electricity retailers who fail to procure the necessary electricity for their demands, soared as well. As a result, many of the new PPSs that procured most of their electricity from transactions in the trading market had a hard time managing their business operations.

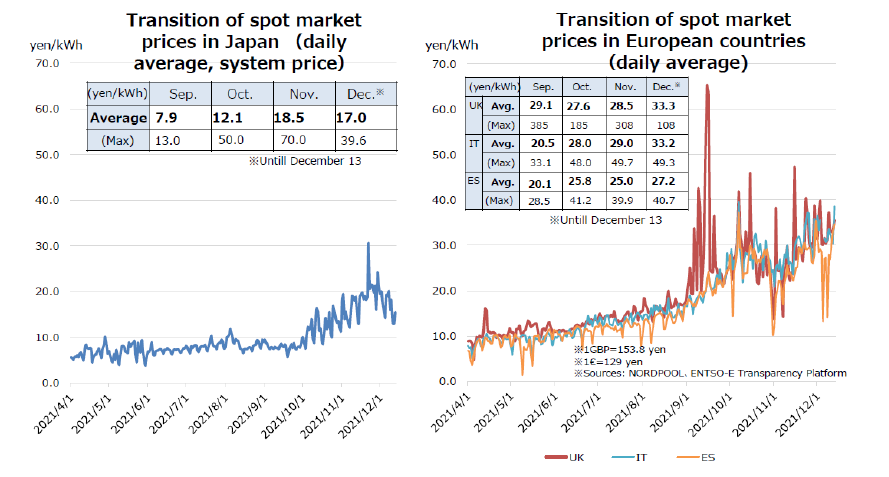

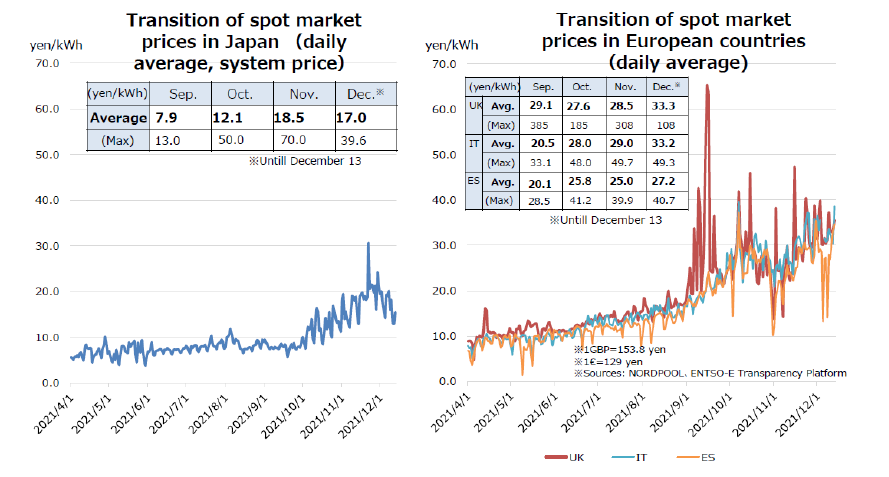

In fiscal 2021, economic recovery from the COVID-19 pandemic, a decrease in upstream investment due to decarbonization, extreme weather conditions and other factors have led to extreme supply and demand pressures and increased fuel prices worldwide. In particular, prices in the wholesale electricity market have increased in Europe in response to rising natural gas prices. In the United Kingdom, 14 out of approximately 50 minor energy suppliers have collapsed and the situation continues to be unstable※3.

In Japan as well, the Organization for Cross-regional Coordination of Transmission Operators (“OCCTO”, a public organization established under the Electricity Business Act) announced in October 2021 that it anticipates that the electricity supply and demand in January and February 2022※4 will be an extremely severe situation since the reserve margin is expected to be slightly above 3%, which is the minimum level for stable supply. In fact, since Autumn 2021, prices in the JEPX spot market seem to be trending upward (although relatively lower than in Europe), which may lay the platform for the market price and imbalance fee to again spike this Winter.

(Translation of Document No. 3-1 of the 42nd Electricity and Gas Basic Policy Subcommittee (Agency for Natural Resources and Energy※5))

In this newsletter, we explain the spike in the market price and imbalance fee mechanism, which both have a major impact on the management of PPSs’ business, and measures that could be taken by PPSs and investors who are considering investing in PPSs.

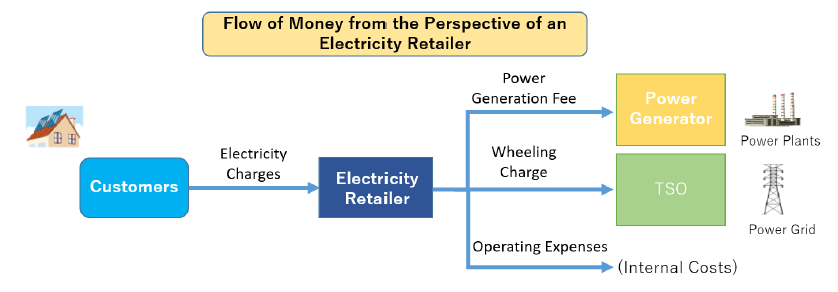

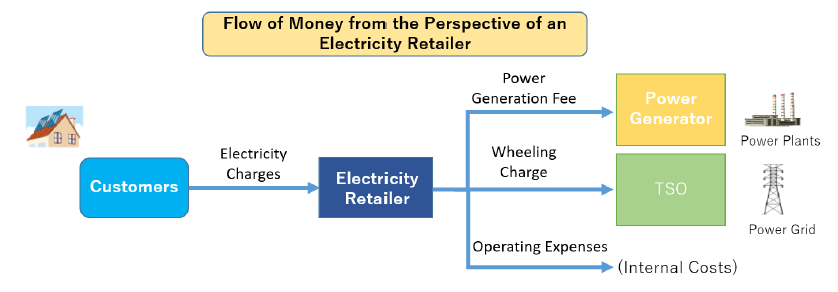

In order to supply electricity to customers, electricity retailers are required to (1) procure electricity from power generators and (2) request electricity transmission to a demand site with an electricity transmission and distribution system operator (TSO’s wheeling services). These two obligations constitute a large part of the total cost of an electricity retailer’s business.

(Translation of Document No. 1 of “Study Group Report on Wheeling Charge” dated July 2016 by the Consumer Commission※6)

Electricity retailers that do not own their own power plants usually procure electricity through (i) OTC agreements with power generators or (ii) transactions on the trading market operated by JEPX. JEPX operates the “spot market” (a market for electricity supplied on the next day after the trade date) and the “intraday market” (a market for electricity supplied on a day when the spot market is closed). The majority of JEPX transactions are conducted in the spot market.

In the spot market, unlike OTC agreements, since volumes and prices of electricity are not fixed until the day before the delivery date, electricity retailers may adopt a flexible procurement strategy in response to changes in demand; notwithstanding the price volatility risk and the risk of failing to procure the necessary electricity volumes.

When electricity retailers request TSO’s wheeling service, they must comply with the “30-minute balancing rule” for the stable supply of electricity.

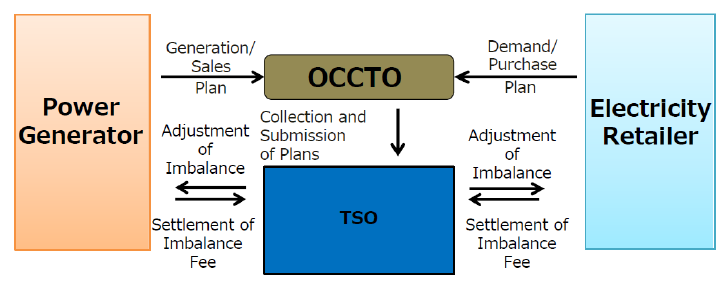

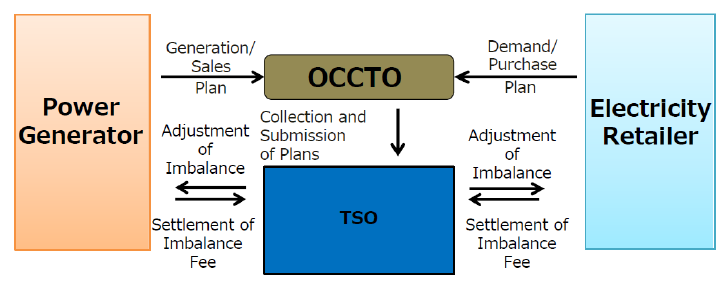

Under this rule, no later than the day before the delivery, (i) an electricity retailer is required to submit a demand plan and purchase plan describing, among others, the amount of electricity demand in every 30 minutes of the next day and its sellers, and (ii) a power generator is required to submit a power generation plan and sales plan describing, among others, the amount of electricity generation in every 30 minutes of the next day and its purchasers. Such plans are to be submitted to TSO through OCCTO. Power generators and electricity retailers are required to match the actual electricity amount of generation/sales or demand/purchase to these planned amounts.

If there is a difference between the amount of electricity stated in a generation/sales plan or a demand/purchase plan and the amount of electricity actually generated/sold or demanded/purchased, TSO is responsible for adjusting the planned amount and the actual amount of electricity by supplying the shortage from their power sources, which they secure to accommodate such differences (control reserves), or by purchasing the excess amount. An “imbalance” occurs when the planned amount is different from the actual amount.

A “shortage imbalance” occurs when the actual amount of generated electricity is less than the planned amount described in the generation/sales plan, or the actual amount of demanded electricity is greater than the planned amount described in the demand/purchase plan (i.e., a situation where TSO needs to supply the shortage). Conversely, a “surplus imbalance” occurs when TSO needs to purchase the excess amount.

In the event of an imbalance, the expenses incurred by TSO in adjusting such imbalance plus penalties is settled between the responsible power generator or electricity retailer and TSO. This charge is known as the “imbalance fee”.

Therefore, electricity retailers are charged a “shortage imbalance fee” if the amount of the demand for electricity exceeds the planned demand amount, or if they fail to procure sufficient electricity equivalent to the actual demand.

(Translation of partially modified Document No. 4 of the 7th Working Group on Review of the System (Agency for Natural Resources and Energy)※7)

The imbalance fee is calculated under the current system in accordance with the following formula.

Shortage imbalance fee =

weighted average value of spot market prices and intraday market prices × α + β + K

Surplus imbalance fee =

weighted average value of spot market prices and intraday market prices × α + β – L

α = adjustment item corresponding to power supply/demand situation for the network as a whole

β = adjustment item reflecting the differences in market prices by region

K/L = incentive index (value determined by the Minister of Economy, Trade and Industry)

The α amount is calculated after the occurrence of the imbalance, which raises the imbalance fee to greater than the market price in the case of shortage situation and reduces it to less than the market price in the case of surplus situation.

That is, the current imbalance fee is calculated based on the JEPX market price at the time when the imbalance occurs, reflecting the nationwide situation of imbalance and adjustments for regional market disparities, and then raising or lowering the prices as compliance incentives.

As mentioned above, since the imbalance fee rises more than the market price in a shortage situation, the imbalance fee and the market price both rose in the winter of fiscal 2020 in such a way that the imbalance fee surged above the market price. That led to electricity retailers purchasing electricity at high prices in order to avoid being charged a high imbalance fee.

In order to address this situation, the imbalance fee system was revised in January 2021 as follows.

From fiscal 2022 onward, a new method of calculating the imbalance fee is scheduled to be introduced, to properly reflect the value of control reserves, that is, costs of control reserves and situation of supply and demand, in the imbalance fee. The Interim Report published on April 10, 2020※9 stated that the higher of the following will apply: (1) under normal circumstances, the marginal kWh price (rather than the JEPX price) of the control reserves will be used to compensate the shortage imbalance, or (2) under certain circumstances of supply and demand pressures, the amount of the imbalance fee which is higher as the control reserves decrease. However, further revisions are under discussion and more amendments are expected.

The revision of the imbalance fee system has, to some extent, lessened the imbalance risk associated with the electricity retail business. However, if supply and demand pressures increase again, there is a risk that JEPX prices will rise and electricity procurement will become difficult once again, which will still result in high imbalance fees.

As shown in the figure in II-1 above, in an electricity retailer’s basic financial structure, the primary source of revenues is limited to electricity charges from customers while the primary costs include: (i) operating expenses (SG&A), (ii) the expense of procuring electricity from power generators, and (iii) wheeling charges to TSOs. If a retailer incurs the shortage imbalance fee, the shortage imbalance fee payable to TSOs would be an additional cost. Since the imbalance fee typically cannot be added to the customers’ electricity charges, the imbalance fee directly reduces the income of an electricity retailer, and, in some cases, may cause the electricity retailer to fall into insolvency. In addition, the impact of the imbalance fee on the management of an electricity retail business is not easy to predict because the amount and the payment dates will be subsequent to the actual delivery of electricity, and thus will have a significant effect on cashflow, particularly for small electricity retailers.

For this reason, for an electricity retail business, it is important to fully recognize the risks associated with the imbalance fee, conduct appropriate risk evaluation and take appropriate risk management steps.

As mentioned above, electricity retailers are required to pay the shortage imbalance fee if their actual amount of electricity demand exceeds the planned amount or if they fail to procure electricity equivalent to the actual amount of electricity demand. Therefore, in order to avoid the shortage imbalance fee, it is imperative for electricity retailers to (1) improve the accuracy of demand forecasts and (2) secure the means of procuring necessary electricity at low cost.

In connection with securing the means of procuring necessary electricity, if an electricity retailer relies on the spot market for much of its electricity procurement (i.e., if the retailer takes short positions), there is a risk of rising market prices during periods of high demand, such as summer and winter. On the other hand, if an electricity retailer relies on its own power plants and/or OTC agreements at fixed prices for much of its electricity procurement (i.e., if the retailer takes long positions), there is a risk of falling market prices during periods of low demand, such as spring and autumn※10.

In order to encourage the prudent management of market price fluctuation risks, METI published a guideline※11 and case studies※12 on November 15, 2021. In the case studies, the following measures in particular are explained as part of an electricity retailer’s risk management flow.

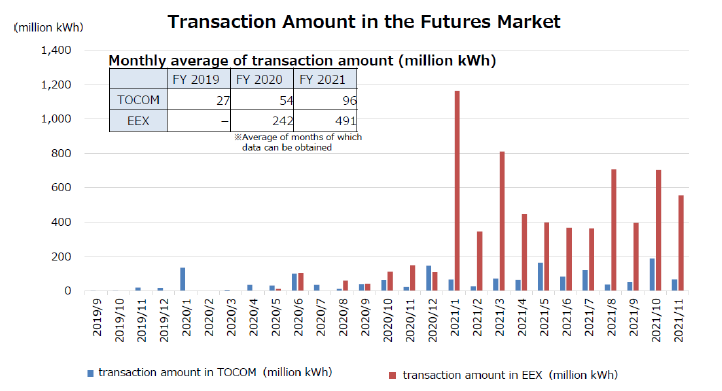

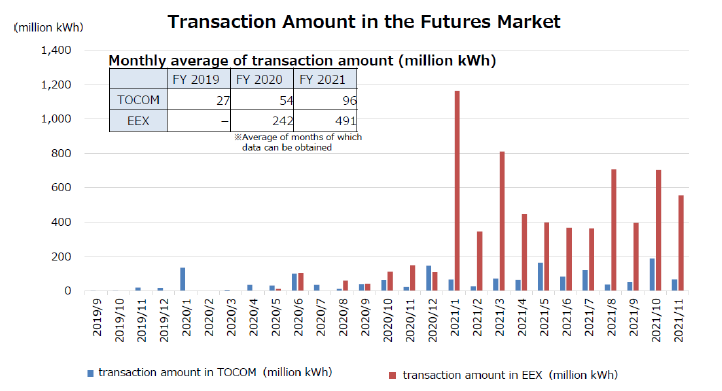

In addition, in the case studies, the following measures are introduced as examples of risk hedging: OTC agreements and owning power plants, the futures market, forward market and base-load market, brokerage transactions, joint procurement of electricity supply, adjustment by retail electricity charges, customer-side demand response (DR)※13, and insurance.

(Translation of Document No. 3-1 of the 42nd Electricity and Gas Basic Policy Subcommittee (Agency for Natural Resources and Energy※14))

The full liberalization of the retail sector in April 2016 greatly resolved many legal obstacles to entering the electricity retail business. However, in order to achieve stable income, it is essential to properly manage the abovementioned market price fluctuations and imbalance risks. Since it is not easy to establish these systems from scratch, acquiring electricity retailers that already have such capabilities in place can be an efficient method of investing in the electricity retail business.

Following the winter of fiscal 2020, there have been a number of acquisitions of electricity retailers, whose management deteriorated due to the increased market price and imbalance fee. If an electricity retailer does not pay the imbalance fee, it could result in the termination of the wheeling service agreement by TSOs, in which case the electricity retailer would not be able to continue as a going concern. Since it is unclear whether or not the special measure for installment payments of the imbalance fee as described above will be introduced in the future, investors need to be aware of the possibility of assuming unpaid imbalance fees when considering conducting M&A in the electricity retail sector.

Legal bankruptcies of electricity retailers have also increased (e.g., the corporate reorganization of F-Power, Inc. in March 2021, the civil rehabilitation of Panair, Inc. in May 2021, and the civil rehabilitation of INFINI Co., Ltd. in September 2021). While there is the possibility of conducting a transfer of business through legal bankruptcy procedures, even in such cases, it should be considered whether it is possible to continue transactions in JEPX and under the OTC agreements with power generators, as well as whether contracts can be maintained with customers. One final important factor to bear in mind is the necessity to enter into discussions with the relevant TSO at the earliest opportunity.

※1

Agency for Natural Resources and Energy website “List of Registered Electricity Retailers”

(https://www.enecho.meti.go.jp/category/electricity_and_gas/electric/summary/retailers_list/)

※2

Document No. 3-1 of the 40th Electricity and Gas Basic Policy Subcommittee (Agency for Natural Resources and Energy)

(https://www.meti.go.jp/shingikai/enecho/denryoku_gas/denryoku_gas/pdf/040_03_01.pdf)

※3

Document No. 3-2 of the 40th Electricity and Gas Basic Policy Subcommittee (Agency for Natural Resources and Energy)

(https://www.meti.go.jp/shingikai/enecho/denryoku_gas/denryoku_gas/pdf/040_03_02.pdf)

※4

“Electricity Supply and Demand Verification Report” dated October 2021 by OCCTO

(https://www.occto.or.jp/iinkai/chouseiryoku/2021/files/211020_denryokujukyukensho.pdf)

※8

This is when the expected reserve margin next date falls below 3% in multiple areas.

※9

Electricity and Gas Market Surveillance Commission website(https://www.emsc.meti.go.jp/info/public/news/20200410001.html)

※10

The risk means that fixed costs are required for own power plants and OTC agreements regardless of season, and during low demand period, surplus power may result in a negative spread even if it can be sold in the market.

※11

“Guidelines on Market Risk Management for Realizing Stable Electricity Services for Regions and Customers”

(https://www.enecho.meti.go.jp/category/electricity_and_gas/electric/summary/regulations/pdf/shijoriskmanagement.pdf)

※12

“Reference Case Studies on Market Risk Management for Realizing Stable Electricity Services for Regions and Customers”

(https://www.enecho.meti.go.jp/category/electricity_and_gas/electric/summary/regulations/pdf/shijoriskmanagement_b.pdf)

※13

This refers to changing the pattern of electricity demand (reduction or increasing demand) by controlling energy resources on the customer side.

This newsletter is given as general information for reference purposes only and therefore does not constitute our firm’s legal advice. Any opinion stated in this newsletter is a personal view of the author(s) and not our firm’s official view. For any specific matter or legal issue, please do not rely on this newsletter but make sure to consult a legal adviser. We would be delighted to answer your questions, if any.

Yuan Yao Lee

Ryuji Oka

(January 2025)

Makoto Ito

(December 2023)

Kei Asatsuma, Tomohiro Okawa (Co-author)

Supasit Boonsanong, Thananya Pholchaniko, Phareeya Yongpanich (Co-author)

(August 2025)

Kaori Sugimoto

(July 2025)

Rintaro Hirano, Yutaro Fujimoto, Yurika Masakane, Yutaro Kato (Co-author)

Yuichi Miyashita, Miho Susuki (Co-author)

(July 2025)

Rintaro Hirano, Yutaro Fujimoto, Yurika Masakane, Yutaro Kato (Co-author)

Justin Ee, Kennosuke Muro (Co-author)

(November 2024)

Rintaro Hirano, Koichiro Yoshimura, Yoshimune Muraji (Co-author)

Dzung Pay

(July 2025)

Rintaro Hirano, Yutaro Fujimoto, Yurika Masakane, Yutaro Kato (Co-author)

Justin Ee, Kennosuke Muro (Co-author)

Yuan Yao Lee

Hoai Tran