Shigeki Minami Shigeki Minami

Partner

Tokyo

ADVANCE Corporate Law Seminar

・Overview of International Tax System Reform

・Outline of the Second Pillar

・Step 1-Determining Applicable Entities and Identifying Constituent Entities (CEs)

・Step 2-Denominator (Group Net Income by Jurisdiction)

・Step 3-Numerator (Adjusted Covered Taxes)

・Step 4-Effective Tax Rate (ETR) and Top-Up Tax Amount

・Step 5-Attribution of International Minimum Taxes “by Jurisdiction”

・Transitional Safe Harbor Period

2025 AIPPI World Congress

Kenji Tosaki (Moderator)

PACIFICO Yokohama North

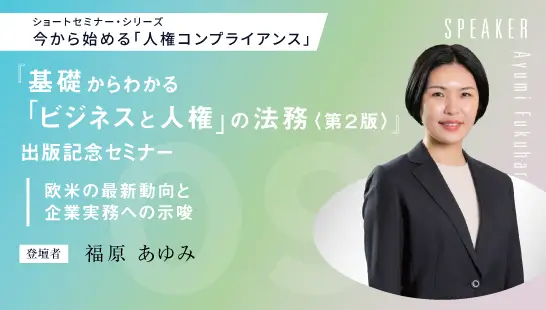

Compliance Seminar Series on Business and Human Rights

Ayumi Fukuhara

Online (On-Demand)

CIArb (EAB) Japan Chapter YMG

Shota Toda

Nishimura & Asahi