NO&T Japan Legal Update

This article is also available in Japanese.

May 24, 2024 saw the promulgation of the “Act on Promotion of Supply and Use of Low-Carbon Hydrogen, etc., for Smooth Transition to a Decarbonized Growth-Oriented Economic Structure” (the “Hydrogen Society Promotion Act”) and “Act on Carbon Dioxide Storage Business” (the “CCS Business Act”), which were passed by the current Diet session. The Hydrogen Society Promotion Act and the CCS Business Act are the first laws in Japan focusing on, respectively, hydrogen- and ammonia-related businesses and carbon dioxide capture and storage businesses.

There has been increasing activity recently at the national level toward the realization of a decarbonized society. In light of these developments, the Hydrogen Society Promotion Act and the CCS Business Act, which serve as foundation for the widespread adoption of hydrogen and ammonia and the societal implementation of carbon dioxide capture and storage business, which are crucial for realizing a decarbonized society, are of great significance. This newsletter provides an overview of these two new laws.

The Hydrogen Society Promotion Act, which is scheduled to come into effect on the date specified by a Cabinet Order within a period not exceeding six months from the date of promulgation, sets out the following key provisions:

The Hydrogen Society Promotion Act aims to promote the early supply (domestic production or import and supply) and use of low-carbon hydrogen by providing various support measures to businesses which have obtained the necessary planning certification. This promotion will facilitate the smooth transition to a decarbonized growth-oriented economic structure, which is the purpose of the GX Promotion Act (the Act on Promotion of Smooth Transition to a Decarbonized Growth-Oriented Economic Structure; cf. Article 1 thereof).

“Low-Carbon Hydrogen” is defined as (i) Hydrogen, (ii) the amount of CO2 emitted from the production of which is less than a certain value, (iii) the use of which contributes to the reduction of CO2 emissions in Japan in light of international decisions on the calculation of CO2 emissions and which (iv) meets certain other requirements specified in the Ordinance (the “Ordinance”) of the Ministry of Economy, Trade and Industry (the “METI”) (Article 2, Paragraph 1.).

“Hydrogen” as used just above is defined as “hydrogen and its compounds, as specified by the Ordinance”. The interim report (the “Interim Report”)※1 released by the METI joint conference prior to its submission to the ordinary Diet session envisioned that “hydrogen” would include ammonia, synthetic methane, and synthetic fuels, but the details have been delegated to the Ordinance to be established in the future.

With reference to the notion of “carbon intensity” (the amount of CO2 emissions per unit of hydrogen production) proposed by Japan at the G7 Sapporo Climate, Energy, and Environment Ministerial Meeting in April 2023, the Interim Report indicates a benchmark value of 3.4 kg CO2/kg-H2 as one standard for the amount of CO2, which is one of the requirements for “Low-Carbon Hydrogen”; the specific benchmark value will, however, be determined in the future.

The competent minister※2 shall formulate a basic policy on the promotion of supply and use of Low-Carbon Hydrogen (Article 3). This policy will describe (i) the significance and goals of the supply and use of Low-Carbon Hydrogen, (ii) the priority contents to be implemented toward the realization of green transformation, and (iii) efforts toward the self-sustained supply of Low-Carbon Hydrogen.

On the basis of this policy, the national government, local governments, and business operators will be responsible for promoting the supply and use of Low-Carbon Hydrogen from their respective standpoints (Articles 4 through 6).

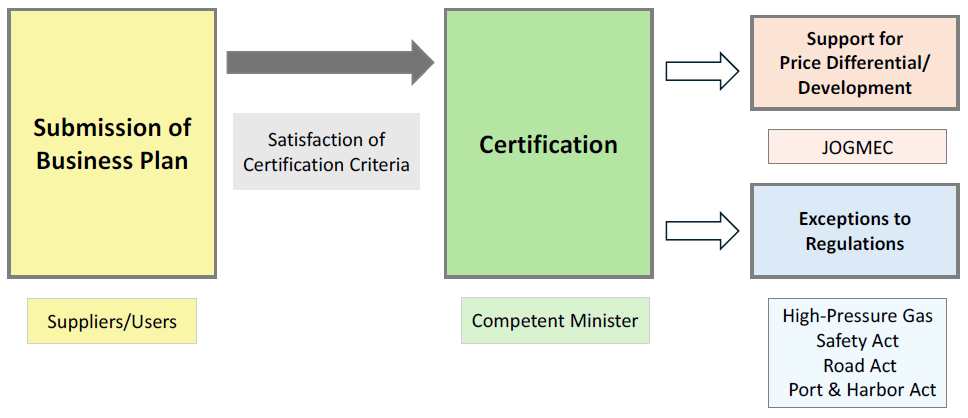

The core of the Hydrogen Society Promotion Act is the introduction of a plan certification system, support measures for certified businesses (price differential support and infrastructure development support), and special regulatory measures.

Business operators importing or supplying Low-Carbon Hydrogen domestically (the “Supplier(s)”), as well as those utilizing Low-Carbon Hydrogen (the “Users”) may independently or jointly prepare and submit a “Business Plan for Low-Carbon Hydrogen Supply, etc.” (the “Business Plan”) to the competent ministry. Upon receiving certification from the minister, these operators become eligible for subsidies for price differential support and infrastructure development support. Additionally, they may receive special exemptions concerning the High-Pressure Gas Safety Act, the Port and Harbor Act, and road occupancy regulations.

When certifying a Business Plan, the relevant minister must ensure that the submitted plan meets all of the following certification criteria (Article 7, Paragraph 5). The certification criteria are summarized as follows:

The Hydrogen Society Promotion Act specifies that JOGMEC shall carry out the following activities as part of its duties: providing subsidies (price differential support) to allocate funds necessary for certified Suppliers to continuously supply Low-Carbon Hydrogen in accordance with the relevant certified Business Plan (the “Certified Business Plan”); and to provide subsidies (infrastructure development support) to allocate funds necessary for such certified Supplier to establish facilities for the storage or transportation of Low-Carbon Hydrogen, or other facilities required for the implementation of the applicable Certified Business Plan, in accordance therewith (Article 10, Item 1).

The Hydrogen Society Promotion Act does not provide detailed provisions regarding the conditions for the provision of subsidies, such as price differential support and infrastructure development support. It is anticipated that JOGMEC will establish such detailed subsidy-related provisions in the future.

The Hydrogen Society Promotion Act introduced a mechanism that allows certified Suppliers to receive certain regulatory exemptions under the premise of a plan certification system.

The Minister of Economy, Trade, and Industry is tasked with establishing criteria that should guide Suppliers in their efforts to promote the supply of Low-Carbon Hydrogen, taking into account (i) the supply status of Low-Carbon Hydrogen by Suppliers, (ii) the technological standards related to the supply, storage, transportation, and (iii) utilization of Low-Carbon Hydrogen, as well as (iv) the economic viability and other factors related to the use of Low-Carbon Hydrogen (Article 32). The details will be specified concretely after the enforcement of the law.

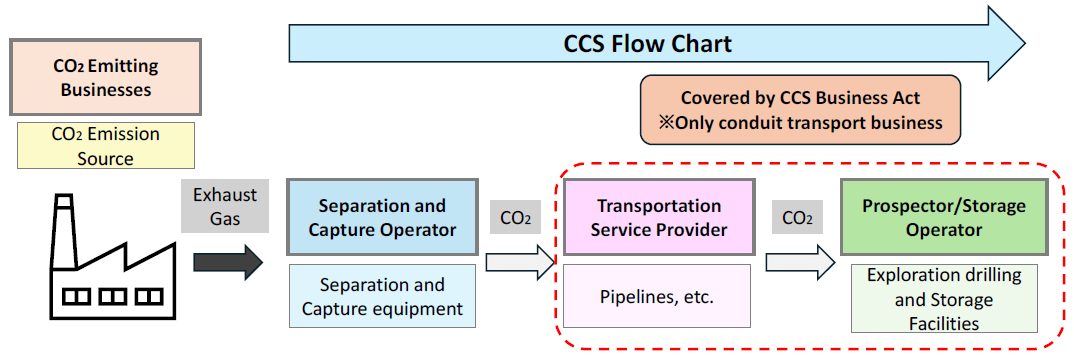

The new CCS Business Act does not serve as a comprehensive business law for the entire CCS value chain but primarily focuses on (i) the establishment of a permit system for exploration drilling and storage activities, together with regulation and safety measures concerning storage activities (Chapter 2) and (ii) regulation and safety measures for pipeline transportation activities (Chapter 3)※4. The full enforcement of the CCS Business Act will occur within two years from the date of its promulgation, as stipulated by Cabinet Order. However, regulations related to prospecting will be enforced within six months from the date of its promulgation, and other provisions will be gradually enforced (Article 1 of the Supplementary Provisions). As of now, no details of any ordinance related to the CCS Business Act have been disclosed.

The CCS Business Act does not determine storage and prospecting operators through a first-to-file system. Instead, the Minister of Economy, Trade, and Industry designates areas with existing or potential storage layers as “Specified Areas” and selects the most suitable operators for storage activities or exploration drilling (the “Storage Activities”) through a public solicitation process (Article 3 and subsequent articles). Those intending to conduct Storage Activities in Specified Areas must apply to the Minister of Economy, Trade, and Industry in accordance with the implementation guidelines for the Specific Area and obtain a permit for such activities for each storage area, as well as for exploration drilling for each prospecting area (Article 4, Paragraph 1). However, operators who have already obtained mining rights under Article 21, Paragraph 1 of the Mining Act for petroleum, combustible natural gas, or other substances specified by Cabinet Order may only obtain a permit for Storage Activities or exploration drilling when intending to conduct such activities in their mining area (limited to areas outside the Specified Areas) (Article 12).

Furthermore, persons other than operators who have obtained permits for Storage Activities (the “Storage Operator(s)”) cannot store carbon dioxide in storage layers, except for carbon dioxide storage as stipulated by the Ordinance related to mineral extraction activities or other activities (Article 13, Paragraph 1). Similarly, individuals other than those who have obtained permits for exploration drilling (the “Prospector(s)”) cannot conduct prospecting activities (Article13, Paragraph 2).

Storage Rights or Prospecting Rights (the “Storage Rights”), similarly to mining rights, are deemed to be in rem rights (Article 12 of the Mining Act), and the provisions on real estate apply mutatis mutandis unless otherwise stipulated in the CCS Business Act (Article 33). As a result, if Storage Rights are infringed upon by a third party, the holder can exercise proprietary rights such as the right to seek removal of the obstruction. However, unlike real estate under the Civil Code, Storage Rights may not be the subject of rights other than general succession, including inheritance, assignment, disposition of delinquency, execution, provisional seizure and provisional disposition (Article 34; provided, however, that they may be subject to a mortgage). Additionally, they cannot be transferred without the approval of the Minister of Economy, Trade, and Industry under Article 17, Paragraph 1 or Paragraph 2 (except by inheritance) (Article 35, Paragraph 1). Furthermore, instead of registration, the establishment, transfer, modification, extinction, and disposal of Storage Rights as well as mortgages over Storage Rights, are carried out by registration in the Storage Rights registration ledger (Article 36).

When permit for Storage Activities is granted, the Minister of Economy, Trade, and Industry publicly announces the fact that such permit has been granted, along with certain particulars such as the name and address of the Storage Operator and the permitted storage area (Article 24). Such announcement establishes the Storage Rights concerning the permitted storage area. Moreover, the exercise of other rights pertaining to the land in the permitted storage area is restricted to the extent necessary to prevent obstruction or interference with carbon dioxide storage or prospecting conducted by the Storage Operator within the permitted storage area (Article 25, Paragraph 1). The period during which other rights pertaining to the land are restricted due to the establishment of Prospecting Rights shall be limited to the period from the date of the announcement until the expiration of the validity period of the Prospecting permit related to the Prospecting Right (Article 25, Paragraph 2).

The CCS Business Act imposes a no-fault liability on operators with respect to liability arising from exploration drilling and Storage Activities (Article 124). In other words, if the storage of carbon dioxide in a storage layer, excavation of land for exploration drilling, discharge of well water, or leakage of carbon dioxide stored in a storage layer causes damage to others, the Storage Operator in the permitted storage area at the time the damage occurred shall be liable for compensation for such damage. As a general rule, compensation for damages shall be in monetary terms; however, if recovery to the original state without incurring significantly more expenses than the amount of compensation is possible, the victim may seek restoration damages to such original state. Further, if the court finds it appropriate upon petition by the person liable for compensation, the court may order restoration of the original state instead of compensation in monetary terms (Article 126, Paragraph 2, Item 3). The above is similar to the compensation mechanism in the Mining Act (Article 109, Paragraph 1 and Article 111, Paragraphs 2 and 3 of the Mining Act).

Pipeline transportation assumes a physical connection between the storage site and the emission source via pipeline, which may lead to a natural monopoly in the region and a dominant position of the transportation operator over the CO2 emitters. Therefore, the CCS Business Act adopts a notification system (Article 78) and imposes certain regulations on businesses engaged in the transportation of carbon dioxide through pipelines for the purposes of storage in storage layers (including those equivalent to storage layers in foreign countries).

In particular, “Specified Pipeline Transportation Service Providers” (i.e., pipeline transportation service providers engaged in the business of transporting carbon dioxide emitted from the activities of other parties on behalf of other parties) are required to establish general terms and conditions for specified pipeline transportation services and notify the Minister of Economy, Trade and Industry (Article 82, Paragraph 1; the same shall apply to amendments of such general terms and conditions). In principle, it is prohibited to conduct pipeline transportation business under conditions other than those stipulated in such general terms and conditions (Article 82, Paragraph 2). In addition, in certain cases, the Minister of Economy, Trade and Industry may order that such general terms and conditions be changed within a reasonable period (Article 82, Paragraph 3). The Specified Pipeline Transportation Service Provider shall not give unjust preferential treatment or benefits, or unjust disadvantageous treatment or disadvantage to any specific person with respect to its business (Article 83).

Pipeline transportation service providers are subject to the same safety regulations as are Storage Operators, including the obligation to maintain pipeline transportation facilities in conformity with technical standards specified by the METI Ordinance (Article 86, Paragraph 1), to make a report in case of disaster (Article 87, Article 68), to formulate and notify safety regulations (Article 88), to notify construction plans (Article 90), to conduct pre-use voluntary inspection of pipeline transportation facilities (Article 91), and to conduct periodic voluntary inspections (Article 92, Article 77).

The current Act on Prevention of Marine Pollution and Maritime Disasters (the “Marine Pollution Prevention Act”) stipulated that no person shall, as a general rule, dispose of oil, hazardous liquid substances, or waste beneath the seabed (including storage beneath the seabed) (Article 18-7). However, the disposal of “Specified Carbon Dioxide Gas” beneath the seabed is allowed only if the Minister of the Environment grants a permit (Article 18-7, Item 2). With the enactment of the CCS Business Act, the sub-seabed disposal permit system for Specified Carbon Dioxide Gas under the Marine Pollution Prevention Act (Article 18-8 of the said Act) will be abolished (Article 14 of the Supplementary Provisions of the CCS Business Act) and integrated into the CCS Business Act.

In this newsletter, we have reviewed the newly Hydrogen Society Promotion Act and the CCS Business Act. In addition to the enactment of future government ordinances and regulations, it is necessary to continue to pay attention to business trends with respect to both the further development of the hydrogen business, which is still in its early stages, the early social implementation of the carbon dioxide capture and storage business.

*1

“Interim Report” (January 29, 2024), Advisory Committee for Natural Resources and Energy, Subcommittee on Energy Efficiency and New Energy, Subcommittee on Hydrogen and Ammonia Policies, Subcommittee on Resources and Fuels, Subcommittee on Decarbonized Fuel Policies, Industrial Structure Council, Subcommittee on Safety and Consumer Product Safety, Subcommittee on Hydrogen Safety.

*2

Depending on the item, it will be both the Minister of Economy, Trade and Industry and the Minister of Land, Infrastructure, Transport and Tourism or the Minister of Economy, Trade and Industry (Article 42, paragraph 1).

*3

The “certain fiscal year” is to be determined by the Minister of Economy, Trade and Industry, and the “certain period of time” is to be determined by the Ordinance, but the details have not been determined at this time.

*4

It also regulates certain other matters, such as the introduction of a permit system for Prospecting of storage layers (Article 107).

This newsletter is given as general information for reference purposes only and therefore does not constitute our firm’s legal advice. Any opinion stated in this newsletter is a personal view of the author(s) and not our firm’s official view. For any specific matter or legal issue, please do not rely on this newsletter but make sure to consult a legal adviser. We would be delighted to answer your questions, if any.

(April 2025)

Shinichiro Horaguchi, Yoshinobu Koyama, Yoshihisa Watanabe, Kaori Sugimoto (Co-author)

(December 2024)

Hiromi Hattori, Yuichi Miyashita (Co-author)

Yuan Yao Lee

Hoai Tran

Yuan Yao Lee

Hoai Tran

(November 2024)

Rintaro Hirano, Koichiro Yoshimura, Yoshimune Muraji (Co-author)

(August 2024)

Rintaro Hirano, Yutaro Fujimoto, Misaki Aono, Naoto Obara (Co-author)

Yuan Yao Lee

(November 2024)

Rintaro Hirano, Koichiro Yoshimura, Yoshimune Muraji (Co-author)

(August 2024)

Rintaro Hirano, Yutaro Fujimoto, Misaki Aono, Naoto Obara (Co-author)

Jiro Mikami, Eiji Miyagi, Yoshihisa Watanabe, Saori Kawai (Co-author)

(December 2024)

Hiromi Hattori, Yuichi Miyashita (Co-author)

(September 2024)

Ryosaku Kondo (Comments)

Yoshihisa Watanabe

Jiro Mikami, Eiji Miyagi, Yoshihisa Watanabe, Saori Kawai (Co-author)